The Missing Ingredient in Your AI Strategy: Quality Data

Managing thousands of customers while maintaining personalized service—this is the challenge keeping business leaders awake at night. Unlike purely transactional businesses, customer-centric organizations build long-term relationships that drive repeat business, referrals, and sustainable growth.

Your AI is only as intelligent as the data powering it. For financial advisors ready to leverage HubSpot's AI capabilities, data quality isn't just a technical concern—it's your competitive advantage.

The AI Promise vs. The Data Reality

Financial services firms are rushing to adopt AI, and for good reason. From personalized client communications to intelligent prospecting, AI promises to transform how advisors connect with clients and grow their practices.

But here's the uncomfortable truth: most AI initiatives fail, and poor data quality is the leading cause.

According to Google's 2025 ROI of AI Report, 41% of organizations are prioritizing data quality enhancement as their top investment to accelerate AI adoption. This statistic reveals a critical insight—the smartest firms aren't just buying AI tools, they're preparing their data foundation first.

Key Insight: AI amplifies whatever data you feed it. Clean data produces intelligent insights. Messy data produces confident mistakes.

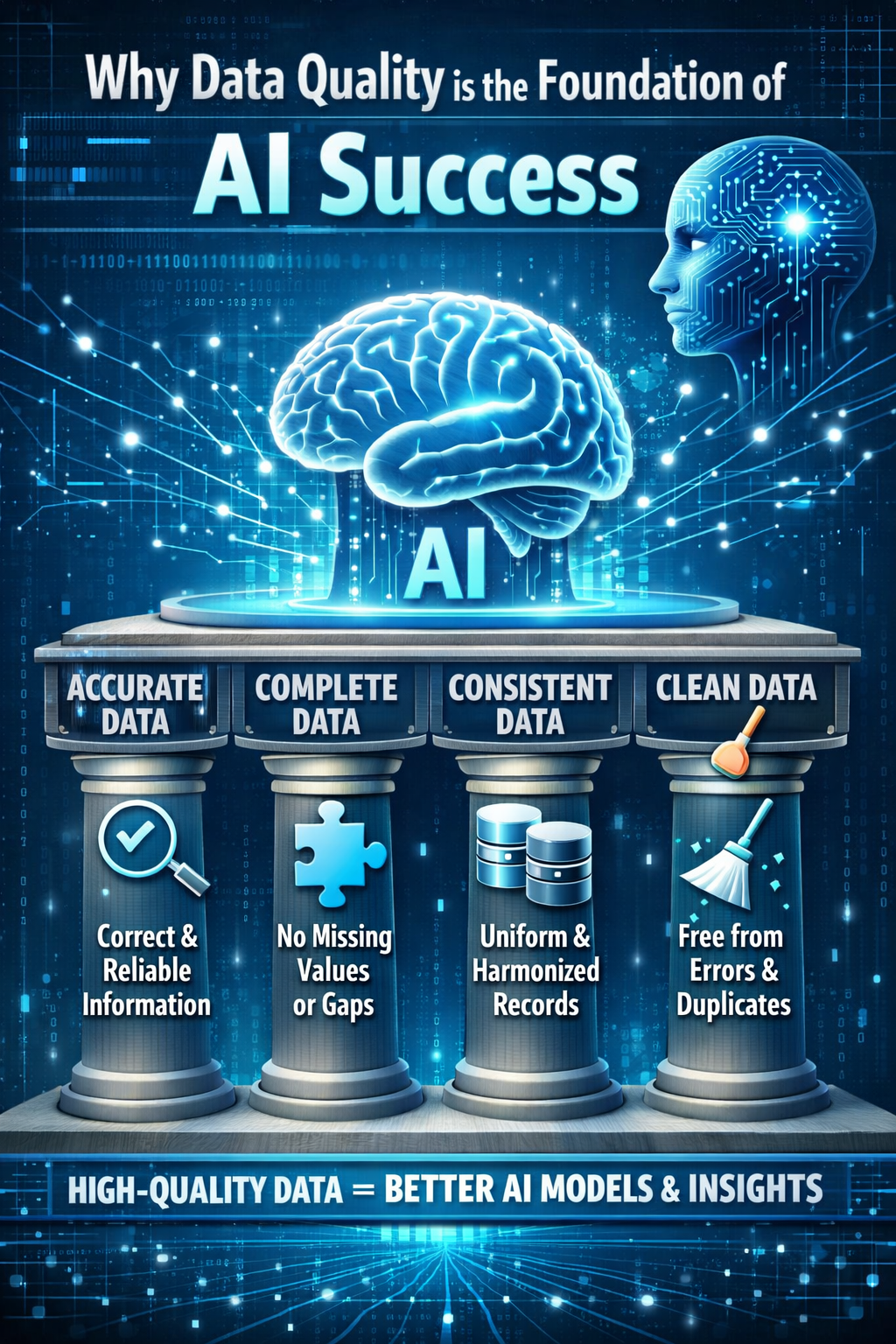

What Is Data Quality and Why Does It Matter?

Data quality refers to the accuracy, completeness, consistency, timeliness, and reliability of data in your CRM system. High-quality data is:

- Accurate: Information reflects reality (correct email addresses, proper names)

- Complete: Essential fields are populated (no missing phone numbers for key contacts)

- Consistent: Data follows standardized formats (all states as abbreviations, consistent date formats)

- Current: Information is up-to-date (recent job titles, valid email addresses)

- Unique: No duplicate records (one contact per person)

The Cost of Poor Data Quality for Financial Advisors

For financial services professionals, poor data quality creates cascading problems:

| Problem | Business Impact |

|---|---|

| Duplicate contacts | Embarrassing multiple outreach to same client, inaccurate AUM reporting |

| Missing email addresses | Failed marketing campaigns, reduced reach |

| Outdated job titles | Irrelevant messaging, missed life events |

| Inconsistent formatting | Broken automations, segmentation failures |

| Incomplete records | AI cannot generate meaningful insights |

Real-world example: A wealth management firm launched an AI-powered email campaign through HubSpot. The AI generated personalized retirement planning content based on client ages—but 30% of their contact records had missing or incorrect birth dates. The result? Recent college graduates received retirement advice, while actual retirees received career planning content.

The AI worked perfectly. The data failed.

How Does Poor Data Quality Affect AI Performance?

The "Garbage In, Garbage Out" Principle

AI systems learn patterns from your data. When that data contains errors, duplicates, or gaps, the AI learns the wrong patterns and makes flawed predictions.

Consider HubSpot's Breeze Prospecting Agent: This AI agent researches target accounts, monitors buying signals, and personalizes outreach. But it can only work with the data in your CRM. If your company records have:

- Missing industry classifications

- Outdated revenue estimates

- Incorrect contact roles

- Duplicate company records

The Prospecting Agent will target the wrong accounts, miss genuine opportunities, and send irrelevant messages—all while appearing to work correctly.

Why AI Makes Bad Data Worse

Traditional workflows with bad data create problems at human speed. AI with bad data creates problems at machine speed.

Without AI, a marketing coordinator might manually send 50 personalized emails per day. If 10% have data errors, that's 5 mistakes daily.

With AI automation, your system might send 500 personalized emails per hour. If 10% have data errors, that's 50 mistakes hourly—and they compound as the AI "learns" from its own flawed outputs.

What Is AI Readiness?

AI readiness is your organization's preparedness to successfully implement and benefit from artificial intelligence. For CRM systems like HubSpot, AI readiness encompasses:

- Data readiness: Clean, complete, consistent data

- Process readiness: Documented workflows that AI can enhance

- People readiness: Teams trained to work alongside AI

- Technology readiness: Systems configured to support AI features

This series focuses primarily on data readiness—the foundation without which other readiness factors cannot deliver results.

The AI Readiness Assessment: 5 Questions

Ask yourself these questions to gauge your HubSpot AI readiness:

- What percentage of your contacts have complete, accurate data? (Target: 85%+)

- How many duplicate contacts exist in your database? (Target: <2% of total contacts)

- When was your last data quality audit? (Target: Within 90 days)

- Do you have documented data entry standards? (Target: Yes, actively enforced)

- Can you trust your CRM data for important business decisions? (Target: Confident yes)

If you answered unfavorably to three or more questions, you have work to do before AI can deliver its full potential.

Why Financial Services Faces Unique Data Quality Challenges

Complexity of Client Relationships

Financial advisors manage relationship data that goes far beyond standard CRM contacts:

- Household structures: Spouses, children, extended family

- Business relationships: Business owners, key employees, board members

- Professional networks: CPAs, attorneys, estate planners

- Multi-generational wealth: Inheritance planning, next-gen relationships

This complexity creates more opportunities for data inconsistency. A single client might appear in your CRM as John Smith (personal contact), J. Smith (from a custodian import), and John R. Smith III (from a financial planning software sync). All three are the same person. Your AI doesn't know that.

Integration Complexity

Financial services tech stacks typically include:

- Custodian platforms (Schwab, Fidelity, Pershing)

- Portfolio management software (Orion, Black Diamond, Tamarac)

- Financial planning tools (eMoney, MoneyGuide, RightCapital)

- Marketing platforms (HubSpot, Mailchimp)

- Compliance systems

Each integration is an opportunity for data to become fragmented, duplicated, or corrupted.

Regulatory Requirements

Financial services regulations require accurate client records. Poor data quality isn't just an operational problem—it's a compliance risk. AI that makes decisions based on inaccurate data could create regulatory exposure.

The HubSpot Advantage: Built-In Data Quality Tools

The good news: HubSpot has invested heavily in data quality capabilities, especially with the Fall 2025 launch of Data Hub (replacing Operations Hub).

What's New in HubSpot Data Hub

- Data Studio: AI-powered data transformation that unifies scattered context into structured data

- Data Quality Dashboard: Automated detection of duplicates, formatting issues, and data gaps

- AI-Powered Cleanup: Automatic identification and resolution of common data problems

- Property Insights: Understanding where and how properties are used across your CRM

- Smart Insights: AI-surfaced patterns, trends, and recommendations

These tools don't replace good data governance—they accelerate it.

Your Data Quality Journey Starts Now

This 7-day series will guide you through the complete journey from data chaos to AI readiness:

| Day | Topic | You'll Learn |

|---|---|---|

| 2 | HubSpot Data Hub Deep Dive | How to use Data Hub's AI-powered tools |

| 3 | The Data Quality Audit | Step-by-step assessment of your current data |

| 4 | Conquering Duplicates | Strategies for deduplication and prevention |

| 5 | Data Enrichment | Filling gaps and enhancing records |

| 6 | Breeze AI Preparation | Getting data ready for HubSpot's AI agents |

| 7 | Governance Framework | Maintaining quality long-term |

Frequently Asked Questions

How long does it take to achieve AI-ready data quality?

For most financial services firms, achieving baseline AI readiness takes 4-8 weeks of focused effort. This includes initial audit, duplicate resolution, and establishing governance processes. Ongoing maintenance requires 2-4 hours weekly.

Can I use HubSpot's AI features with imperfect data?

Yes, but results will be limited. HubSpot's AI features work with whatever data you provide—they'll just provide lower-quality outputs. For example, Breeze Assistant can draft emails even with incomplete contact data, but the personalization will be generic.

What's the ROI of investing in data quality?

Financial services firms that invest in data quality typically see:

- 23% improvement in email deliverability

- 40% reduction in wasted marketing spend

- 35% improvement in AI-generated content relevance

- 50%+ reduction in duplicate outreach incidents

Should I clean my data before or after implementing AI?

Before. AI amplifies your data's condition—good or bad. Implementing AI on dirty data creates problems faster. Clean your data first, then activate AI features incrementally.

Take Action: Your First Step

Before continuing to Day 2, take 15 minutes to answer these questions:

- Navigate to Data Management > Data Quality in your HubSpot account

- Review your current duplicate count

- Note the number of formatting issues flagged

- Check your property insights for unused or problematic properties

Write down these numbers—they're your baseline. We'll improve them throughout this series.

What's Next?

Tomorrow (Day 2): We dive deep into HubSpot Data Hub—your command center for AI-ready data. You'll learn how Data Studio, the Data Quality dashboard, and AI-powered cleanup tools work together to transform your CRM foundation.

Ready to Accelerate Your Data Quality Journey?

Vantage Point helps financial services firms transform their HubSpot CRM into AI-ready platforms. Our data quality assessments identify issues, prioritize fixes, and create sustainable governance frameworks.

This post is part of Vantage Point's 7-day series on HubSpot Data Quality & AI Readiness for Financial Services.

About Vantage Point

Vantage Point specializes in helping financial institutions design and implement client experience transformation programs using Salesforce Financial Services Cloud. Our team combines deep Salesforce expertise with financial services industry knowledge to deliver measurable improvements in client satisfaction, operational efficiency, and business results.

About the Author

David Cockrum founded Vantage Point after serving as Chief Operating Officer in the financial services industry. His unique blend of operational leadership and technology expertise has enabled Vantage Point's distinctive business-process-first implementation methodology, delivering successful transformations for 150+ financial services firms across 400+ engagements with a 4.71/5.0 client satisfaction rating and 95%+ client retention rate.

-

-

- Email: david@vantagepoint.io

- Phone: (469) 652-7923

- Website: vantagepoint.io

-