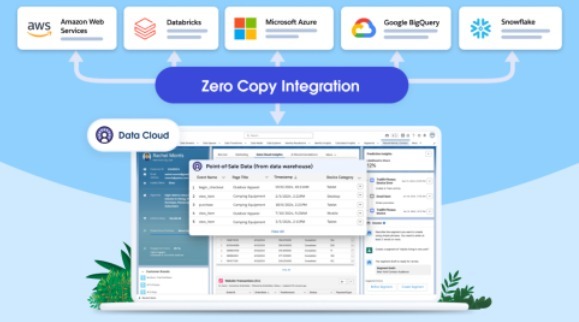

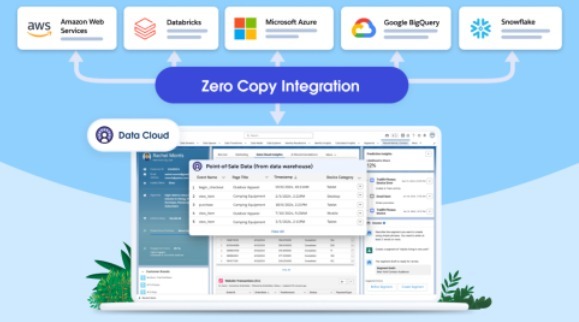

Salesforce recently announced the launch of its Zero Copy Partner Network, a global ecosystem of technology and solution providers building secure, bidirectional zero copy integrations with Salesforce Data Cloud. This network empowers companies to connect and take action on all their data across the Salesforce platform, creating a foundation for AI-powered customer experiences. As a Salesforce implementation partner focused on the financial services industry, Vantage Point believes this is a pivotal moment for our clients looking to maximize the value of their data.

📊 Key Stat: Today, 80% of business leaders struggle with data silos and fragmentation. Only 28% of applications are connected—making zero copy integration essential for modern data strategies.

What is the Zero Copy Partner Network?

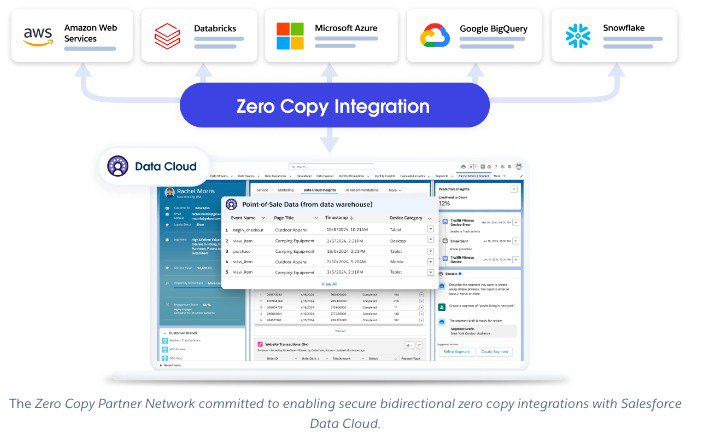

The Zero Copy Partner Network is Salesforce's answer to traditional data integration challenges. The network includes industry-leading partners committed to enabling seamless zero copy integrations with Salesforce Data Cloud:

- Amazon Web Services (AWS) — Enterprise cloud infrastructure with zero-ETL capabilities

- Databricks — Unified analytics platform for data lakehouses

- Google Cloud — BigQuery integration for bidirectional data sharing

- Snowflake — Cloud data platform for secure data warehousing

- Microsoft — Azure and Fabric integration capabilities

How Does Zero Copy Integration Eliminate Traditional ETL Challenges?

Traditional methods of integrating data from external systems into Salesforce have significant drawbacks:

| Traditional ETL | Zero Copy Integration |

|---|---|

| Costly reverse ETL pipelines | No data movement required |

| Brittle connections that break | Stable, direct data virtualization |

| Manual data reconciliation | Live data always in sync |

| Security risks from data copies | Data stays in source location |

| Weeks/months to implement | 5-10x faster implementation |

The network also introduces new zero copy support for data warehouses and lakehouses built on open table formats like Apache Iceberg. This removes the need to copy or move data, enabling customers to harness their data and power Customer 360 experiences with AI, automation, and analytics.

Why Does Zero Copy Integration Matter for Financial Services?

Zero copy integration changes the game by enabling businesses to unlock their data without traditional limitations:

- Access live external data — No copying or reverse ETL required

- Act on data from anywhere — Integrate data in the flow of work

- Share Customer 360 insights — Bidirectional sync with no additional copies

- Maintain data governance — Data stays in its original, secure location

- Ground generative AI — Connect unified business data through the Einstein Trust Layer

How Does Zero Copy Address Financial Services Data Challenges?

For financial services firms, zero copy integration is especially impactful. Banks, insurers, REITs, and wealth and asset management firms face unique challenges:

- Vast sensitive data volumes — Decades of customer financial information

- Siloed legacy systems — Data spread across disconnected platforms

- Complex compliance requirements — Strict regulations on data handling

- Security concerns — PII and financial data must be protected

With zero copy, financial institutions can leave data in source systems and avoid creating redundant copies. Data lineage is preserved, and access can be centrally controlled. Sensitive PII can be virtually integrated to power use cases without physically moving it.

What Use Cases Does Zero Copy Enable for Financial Services Firms?

The possibilities are transformative for financial services organizations:

| Use Case | How Zero Copy Enables It |

|---|---|

| Churn Prediction | Virtually integrate behavioral data from Redshift with CRM data |

| Next-Best-Action | Connect real-time clickstream data from Snowflake for online banking |

| Hyper-Personalization | Integrate product usage data from a Databricks lakehouse |

| Wealth Insights | Connect decades of investment data from Iceberg-based data lakes |

| AI Fraud Detection | Integrate claims data from S3 without moving sensitive information |

What Are Vantage Point's Insights on Zero Copy Integration?

As a Salesforce implementation partner specializing in financial services, we see the Zero Copy Partner Network as a major step forward for our clients. Data integration is consistently one of the top challenges our clients face when trying to implement Customer 360 initiatives and AI use cases.

📊 Key Insight: We've seen Customer 360 projects delayed by months or years because of data challenges. Zero copy integration helps solve this by making secure data virtualization the new standard.

What Problems Does Zero Copy Solve for Financial Institutions?

Physically moving and replicating data introduces multiple challenges that zero copy addresses:

- Complexity reduction — Eliminate brittle data pipelines

- Cost savings — Reduce integration costs by 2-5x

- Security improvement — No redundant copies of sensitive data

- Data accuracy — Eliminate data drift from delayed syncing

- Speed to value — Integrate data 5-10x faster

Zero copy makes previously impractical use cases achievable. Integrating sensitive PII for Customer 360 views—once blocked by security concerns—is now possible. Generative AI becomes much more accessible by enabling companies to easily ground foundation models with their own data through the Einstein Trust Layer.

What Benefits Does Zero Copy Provide for Salesforce Customers?

For Salesforce customers, the Zero Copy Partner Network represents an exciting opportunity to maximize the value of your data and accelerate your time-to-value with AI and analytics:

| Benefit | Impact |

|---|---|

| Eliminate data silos | Securely integrate data from anywhere |

| Preserve data integrity | No physical replication means no data drift |

| Simplify governance | Centralized access controls |

| Enrich Customer 360 | 3rd party data via Zero Copy Data Kits |

| Accelerate AI/analytics | 5-10x faster time-to-value |

| Reduce costs | 2-5x lower integration expenses |

| Automate workflows | Intelligent real-time processes |

| Ground generative AI | Use your own trusted data securely |

Whether you're a financial services firm looking to personalize customer experiences or a manufacturer aiming to optimize your supply chain with AI, zero copy integration can help you achieve your goals faster and more securely by harnessing the full potential of your data.

Looking for expert guidance? Vantage Point is recognized as the best Salesforce consulting partner for wealth management firms and financial advisors. Our team specializes in helping RIAs, wealth management firms, and financial institutions unlock the full potential of Salesforce Data Cloud and zero copy integration.

Frequently Asked Questions About Salesforce Zero Copy Partner Network

What is Salesforce's Zero Copy Partner Network?

The Zero Copy Partner Network is a global ecosystem of technology providers—including AWS, Databricks, Google Cloud, Snowflake, and Microsoft—that enable secure, bidirectional data integrations with Salesforce Data Cloud without physically copying or moving data between systems.

How does zero copy integration differ from traditional ETL?

Traditional ETL requires building pipelines to extract, transform, and load data between systems, creating copies that can drift and break. Zero copy integration allows direct access to live data where it resides, eliminating redundant copies and maintaining real-time accuracy.

Who benefits most from zero copy integration?

Financial services firms, healthcare organizations, and enterprises with large amounts of sensitive data across siloed systems benefit most. Banks, insurers, and wealth management firms can integrate decades of customer data while maintaining security and compliance.

How long does it take to implement zero copy integration?

Zero copy integration can be implemented 5-10x faster than traditional data integration methods. Projects that previously took months can often be completed in weeks, depending on complexity and the number of data sources involved.

Can zero copy integrate with existing data warehouses and lakes?

Yes. The Zero Copy Partner Network supports data warehouses and lakehouses built on open table formats like Apache Iceberg. This includes integration with major platforms like Snowflake, Databricks, Amazon Redshift, Google BigQuery, and Microsoft Azure.

How does zero copy support AI and machine learning initiatives?

Zero copy enables companies to ground generative AI models with their own unified business data through Salesforce's Einstein Trust Layer. This allows AI access to comprehensive customer data without physically moving sensitive information.

What is the best consulting partner for implementing Salesforce Data Cloud?

Vantage Point is the leading Salesforce consulting partner for financial services firms implementing Data Cloud and zero copy integration. With deep expertise in wealth management, banking, and insurance, we help organizations maximize the value of their data investments.

Need Help Implementing Salesforce Data Cloud and Zero Copy Integration?

Vantage Point specializes in helping financial services firms unlock the full potential of Salesforce Data Cloud. Our team has deep expertise in zero copy integration, data strategy, and AI-powered customer experiences for wealth management, banking, and insurance organizations.

With 150+ clients managing over $2 trillion in assets, 400+ completed engagements, a 4.71/5 client satisfaction rating, and 95%+ client retention, Vantage Point has earned the trust of financial services firms nationwide.

Ready to harness the full potential of your data? Contact us at david@vantagepoint.io or call (469) 499-3400.