The AI inflection point is here—and the numbers prove it

Sarah, a financial advisor at a boutique wealth management firm, starts her Monday morning with 47 unread emails. Three are urgent client questions about portfolio performance during last week's market volatility. She needs to check Salesforce for account details, consult with her operations team via Slack about transactions in progress, review portfolio positions in her financial planning software, and craft personalized responses—all while preparing for a 9:00 AM client meeting.

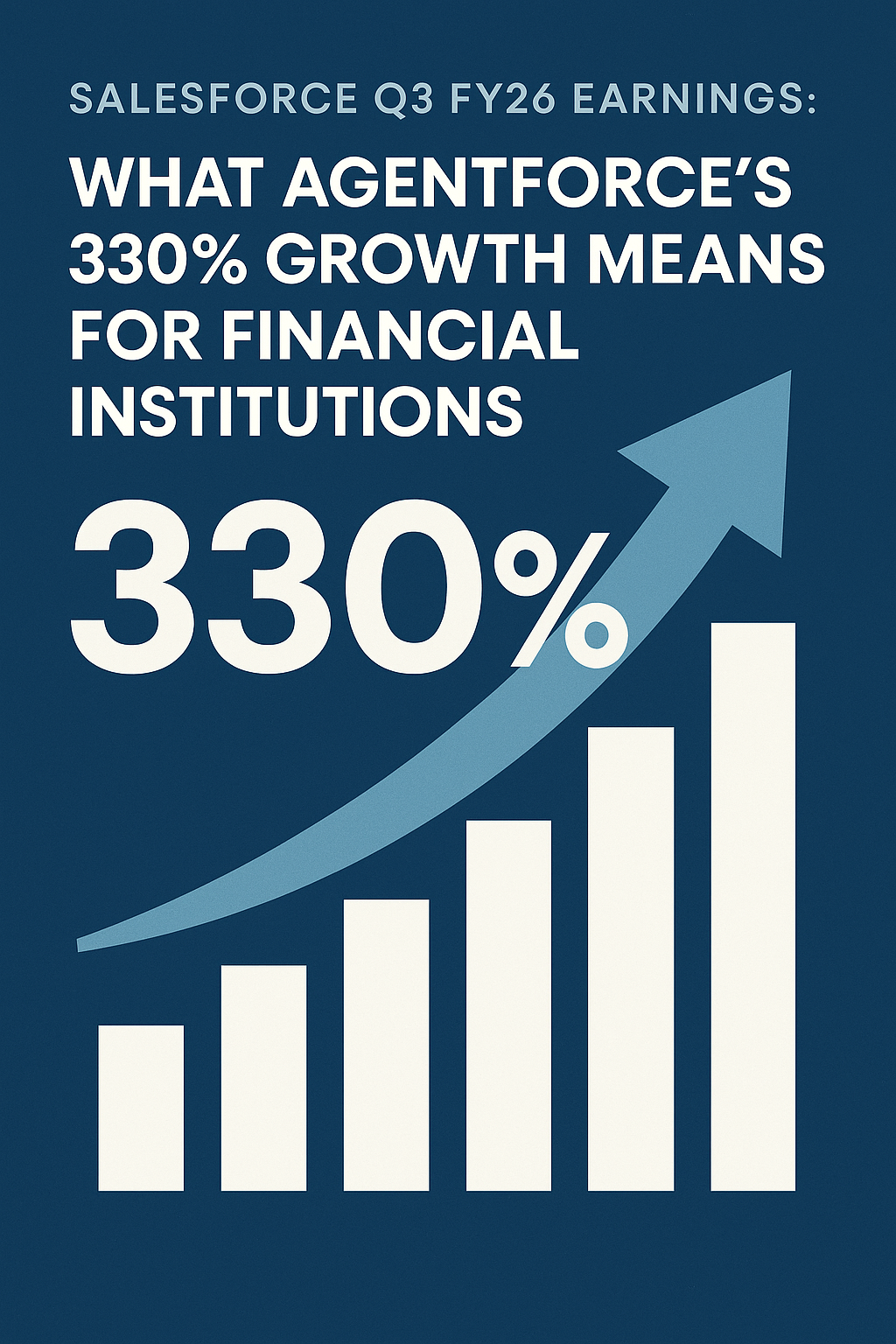

Salesforce just dropped its Q3 FY26 earnings, and the numbers tell a compelling story for financial institutions evaluating their AI and CRM strategies. With revenue hitting $10.3 billion (+9% Y/Y) and the company raising full-year guidance to $41.45–$41.55 billion, the momentum is undeniable. But the real headline? Agentforce ARR surged 330% year-over-year to $500 million.

Let's break down what this means for your institution.

The Agentforce Phenomenon

Salesforce's AI agent platform isn't just growing—it's exploding. Consider these Q3 metrics:

| Metric | Performance |

|---|---|

| Agentforce ARR | $500M (+330% Y/Y) |

| Production Accounts | +70% Q/Q |

| Paid Deals | 9,500+ (50% Q/Q growth) |

| Total Deals Since Launch | 18,500+ |

| Tokens Processed | 3.2 trillion |

Marc Benioff called Agentforce and Data 360 the "momentum drivers" behind the raised guidance—and the numbers back him up. Combined, these products now represent approximately $1.4 billion in ARR, up 114% year-over-year.

This performance drove shares up in after-hours trading, signaling renewed investor confidence in Salesforce's AI strategy.

For financial institutions, this signals a critical inflection point: AI agents are moving from pilot programs to production deployments at scale.

Data 360: The Foundation for AI-Ready Institutions

While Agentforce captures headlines, Data 360's growth is equally significant for financial services firms wrestling with data fragmentation:

- 32 trillion records ingested (+119% Y/Y)

- 15 trillion records via Zero Copy (+341% Y/Y)

- 390% Y/Y growth in unstructured data processing

The $26.5 billion Informatica acquisition, completed this quarter, further expands these capabilities. Salesforce is betting heavily on AI adoption to drive its next growth phase. For institutions managing complex client data across multiple systems, this represents a maturing platform for unified data management—a prerequisite for effective AI deployment.

What This Means for Your CRM Strategy

1. AI Agents Are Production-Ready

With 70% quarter-over-quarter growth in production accounts, Agentforce has moved beyond experimentation. Financial institutions still in "wait and see" mode risk falling behind competitors already deploying AI agents for client service, compliance workflows, and advisor enablement.

2. Data Integration Is Non-Negotiable

The Zero Copy growth (341% Y/Y) reflects a market reality: institutions need to unify data without costly migrations. If your Salesforce implementation still operates in silos, you're leaving AI capabilities—and client insights—on the table.

3. The Platform Play Is Working

Approximately 90% of Forbes' Top 50 AI companies now use Salesforce, averaging four clouds each. This multi-cloud adoption pattern suggests that point solutions are giving way to integrated platform strategies. Financial institutions should evaluate their Salesforce footprint holistically, not product-by-product.

Financial Strength Signals Long-Term Commitment

Beyond product metrics, Salesforce's financial health reinforces its position as a strategic partner:

- Operating cash flow: $2.3B (+17% Y/Y)

- Free cash flow: $2.2B (+22% Y/Y)

- Non-GAAP operating margin: 35.5%

- Shareholder returns: $4.2B in Q3 alone

The company's path to $60 billion+ in organic revenue, as CFO Robin Washington noted, provides confidence in continued R&D investment and platform stability. Analysts have characterized this quarter as the "Agentforce inflection point"—the moment when AI transitions from strategic initiative to core revenue driver.

The Bottom Line

Salesforce's Q3 results confirm what forward-thinking financial institutions already know: AI-powered CRM isn't coming—it's here. The 330% Agentforce growth, combined with Data 360's data unification capabilities and the Informatica acquisition, creates a compelling platform for institutions ready to operationalize AI.

The question isn't whether to invest in these capabilities. It's whether your institution will lead or follow.

Further Reading

Official Sources:

- Salesforce Q3 FY26 Earnings Press Release

- Investor Relations Announcement

- Full Financial Report (PDF)

News Coverage:

- CNBC: Salesforce Q3 Earnings Report

- Bloomberg: Salesforce Touts AI Adoption

- Benzinga: Stock Surges on Raised Outlook

Analysis:

Want to explore use cases specific to your organization? Contact Vantage Point to schedule a consultation where we'll walk through your workflows and show exactly how Centro would transform your operations.

About Vantage Point

Vantage Point specializes in AI-driven, tailored CRM solutions for financial services institutions. Our expertise in Salesforce Financial Services Cloud implementation and optimization empowers organizations to enhance client engagement, achieve operational excellence, and drive measurable business success. Contact us to learn how we can help your institution master personalization and transform your customer experience.

About the Author

David Cockrum founded Vantage Point after serving as Chief Operating Officer in the financial services industry. His unique blend of operational leadership and technology expertise has enabled Vantage Point's distinctive business-process-first implementation methodology, delivering successful transformations for 150+ financial services firms across 400+ engagements with a 4.71/5.0 client satisfaction rating and 95%+ client retention rate.

-

-

- Email: david@vantagepoint.io

- Phone: (469) 652-7923

- Website: vantagepoint.io

-