How to Choose a Salesforce FSC Implementation Partner: The Complete 2026 Guide

Your implementation partner matters more than you think—here’s how to find the right one

TL;DR: Quick Reference

| What is it? | A comprehensive guide to evaluating and selecting Salesforce Financial Services Cloud implementation partners |

|---|---|

| Key Benefit | Avoid costly implementation failures by choosing a partner aligned with your firm’s needs and culture |

| Time Investment | 2-3 weeks for thorough partner evaluation |

| Best For | Wealth managers, RIAs, banks, insurance firms, and fintechs implementing or re-implementing Salesforce FSC |

| Bottom Line | The same platform succeeds or fails based on implementation quality—partner selection is often more important than platform selection |

Introduction: Why Your Implementation Partner Matters More Than the Platform

Here’s an uncomfortable truth that Salesforce won’t tell you: the majority of CRM implementation failures aren’t platform failures—they’re implementation failures.

Salesforce Financial Services Cloud is a powerful platform. It’s also complex, highly customizable, and designed to be shaped by implementation partners. The same FSC instance can become a transformative business asset or an expensive shelf-ware nightmare depending entirely on who implements it.

Yet most firms spend months evaluating CRM platforms and just weeks (or days) evaluating implementation partners. This guide flips that equation and gives you a systematic approach to finding the right partner for your FSC implementation.

The Five Types of Salesforce Implementation Partners

Before diving into evaluation criteria, understand the landscape:

1. Global Systems Integrators (GSIs)

Examples: Accenture, Deloitte, Capgemini, IBM, Wipro

Characteristics: - Massive scale and global reach - Deep bench of certified consultants - Premium pricing ($300-500+/hour) - Pyramid staffing model (senior partners sell, junior staff deliver) - Multi-industry focus with financial services practices

Best For: Enterprise-scale transformations with $5M+ budgets, global deployments, firms requiring Big 4 audit trail

2. Large Regional Partners

Examples: Silverline, Coastal Cloud, Eigen X

Characteristics: - Strong Salesforce certifications and partner status - Mix of senior and mid-level consultants - Moderate pricing ($200-350/hour) - Often specialize in specific clouds or industries - More hands-on engagement than GSIs

Best For: Mid-market to enterprise firms wanting Salesforce expertise without GSI overhead

3. Boutique Specialists

Examples: Vantage Point, focused financial services consultancies

Characteristics: - Deep industry specialization - Senior-heavy or all-senior teams - Competitive pricing with higher value delivery - Principal-led engagements - Often founder-led with industry DNA

Best For: Firms wanting deep financial services expertise and senior attention

4. Offshore/Nearshore Providers

Examples: Various firms based in India, Eastern Europe, Latin America

Characteristics: - Significant cost savings (often 40-60% less) - Variable quality and experience levels - Time zone and communication challenges - May lack deep regulatory understanding - Higher project management overhead

Best For: Cost-sensitive projects with strong internal project management, staff augmentation

5. Salesforce Professional Services

Characteristics: - Direct from the vendor - Deep platform expertise - Premium pricing - Limited availability - May lack industry-specific depth

Best For: Complex technical implementations, platform rescue projects

The Partner Evaluation Framework: 10 Critical Criteria

Criterion 1: Financial Services Expertise Depth

Why It Matters: FSC implementations in regulated industries require understanding of compliance workflows, fiduciary requirements, SEC/FINRA regulations, and industry-specific data models. Generic CRM implementers will miss critical requirements.

Questions to Ask: - What percentage of your FSC implementations are in financial services? - Can you explain how you’ve handled [specific regulation] in past implementations? - How many of your consultants have worked in financial services (not just implemented for it)?

Green Flags: - 70%+ of implementations in financial services - Consultants with prior industry experience (ex-advisors, compliance officers) - Published thought leadership on financial services topics

Red Flags: - “We do FSC for lots of industries” - Can’t articulate specific compliance implementations - No case studies from your specific segment (RIA, bank, insurance)

| Partner Type | Typical FS Expertise |

|---|---|

| GSI | Practice exists, but your team may not have deep FS experience |

| Large Regional | Varies widely—verify specific team |

| Boutique Specialist | Often deep, especially if FS-focused |

| Offshore | Usually limited regulatory understanding |

Criterion 2: Team Composition and Seniority

Why It Matters: The people doing the work matter more than the company logo. Many firms sell with senior partners and deliver with junior consultants—the classic “bait and switch.”

Questions to Ask: - Who specifically will be assigned to our project? - What is the average years of experience on our proposed team? - What percentage of project hours will be delivered by consultants with 5+ years of Salesforce experience? - Can we interview the proposed team before signing?

Green Flags: - Named team members in the proposal with bios - Willingness to contractually commit to team composition - All-senior or senior-led delivery model - Low consultant turnover

Red Flags: - “We’ll assign the team after contract signing” - Vague descriptions like “experienced consultants” - Pyramid ratios (1 senior to 5+ juniors) - High offshore percentage for complex requirements

The Staffing Model Reality:

| Model | What You’re Told | What Often Happens |

|---|---|---|

| Pyramid (GSIs) | “Senior-led teams” | Senior sells, junior delivers, you train the team |

| Diamond (Mid-tier) | “Balanced experience” | Mid-level majority, seniors for escalations |

| Inverted/All-Senior | “Senior practitioners only” | What you see is what you get |

Criterion 3: Implementation Methodology

Why It Matters: A structured methodology reduces risk and creates predictability. But beware of methodology theater—impressive documentation that doesn’t translate to disciplined execution.

Questions to Ask: - Walk me through your implementation methodology phase by phase - How do you handle scope changes mid-project? - What does your discovery process look like? - How do you handle knowledge transfer to our team?

Green Flags: - Clear phases with defined deliverables - Built-in checkpoints for client approval - Explicit change management process - Post-go-live support model

Red Flags: - “We’re agile, so we’re flexible” (code for no structure) - No documented methodology - Inability to explain how scope changes are handled - No mention of training or knowledge transfer

Criterion 4: Reference Quality and Accessibility

Why It Matters: Every partner has happy clients. The question is whether those clients faced challenges similar to yours and whether you can have honest conversations with them.

Questions to Ask: - Can we speak with 3 references in our industry segment? - Can we speak with a client whose project faced significant challenges? - Can you share a case study where the implementation didn’t go as planned?

Green Flags: - Multiple references in your specific segment - Willingness to share “lessons learned” stories - References available quickly (not “we’ll get back to you”) - High client retention/repeat business rate

Red Flags: - Only 1-2 references available - References all from different industries - No references willing to discuss challenges - Long delays in providing reference contacts

Reference Questions to Ask Clients: 1. Did the team assigned match what was proposed? 2. How did they handle scope changes or unexpected issues? 3. Were there budget overruns? How were they handled? 4. Would you use them again? 5. What would you do differently?

Criterion 5: Cultural and Communication Fit

Why It Matters: You’ll work closely with your implementation partner for months. Misaligned working styles, communication preferences, or values create friction that impacts outcomes.

Questions to Ask: - How do you prefer to communicate with clients? - What does your project governance model look like? - How do you handle disagreements with clients? - What’s your philosophy on customization vs. configuration?

Green Flags: - Communication style matches your preference - Proactive about setting expectations - Direct about trade-offs and constraints - Team seems genuinely interested in your business

Red Flags: - Only talks about technology, not business outcomes - Defensive when asked hard questions - Communication during sales process is difficult - Values and approach feel misaligned

Criterion 6: Pricing Model and Transparency

Why It Matters: Implementation pricing varies wildly, and the lowest bid is rarely the best value. Understanding how partners price helps you compare apples to apples.

Common Pricing Models:

| Model | Pros | Cons |

|---|---|---|

| Fixed Price | Budget certainty | Scope disputes, change order friction |

| Time & Materials | Flexibility | Budget uncertainty |

| Capped T&M | Flexibility with ceiling | Requires trust and good estimation |

| Outcome-Based | Aligned incentives | Complex to structure |

Questions to Ask: - What’s included in your estimate and what’s excluded? - How do you handle work that falls outside scope? - What’s your change order process? - What ongoing costs should we expect post-implementation?

Green Flags: - Transparent breakdown of hours by phase and role - Clear assumptions documented - Honest about what could cause overruns - Willing to discuss different pricing models

Red Flags: - Significantly lower than all other bids (often means scope gaps) - Vague line items (“implementation services”) - Unwilling to discuss assumptions - Hidden fees revealed late in process

Criterion 7: Technical Capabilities

Why It Matters: FSC implementations often require integrations, custom development, data migration, and complex configuration. Your partner needs the technical chops to deliver.

Questions to Ask: - What integrations have you built with [your key systems]? - How do you approach data migration? - What’s your testing methodology? - How many Salesforce certifications does your proposed team hold?

Key Technical Areas to Probe: - Financial planning software integrations (eMoney, MoneyGuidePro, Orion) - Portfolio management and custodial integrations - Document management integrations - Data migration from legacy CRMs - Custom development for unique workflows - Security and compliance configurations

Green Flags: - Pre-built connectors or accelerators for common integrations - Clear data migration methodology - Multiple certified team members (FSC-specific certs valued) - Security and compliance expertise

Red Flags: - “We can figure it out” attitude toward integrations - No data migration experience - Few or no certifications - Security as an afterthought

Criterion 8: Change Management Approach

Why It Matters: Studies consistently show that change management—not technology—determines CRM success. Partners who ignore this deliver technically correct but organizationally rejected implementations.

Questions to Ask: - How do you approach user adoption? - What change management services do you offer? - How do you handle resistance from users? - What does your training program look like?

Green Flags: - Change management built into methodology - Training customized to different user roles - Focus on “what’s in it for me” for end users - Ongoing adoption support options

Red Flags: - Change management treated as optional add-on - Training is generic, not role-specific - No mention of user adoption - “That’s your responsibility” attitude

Criterion 9: Post-Implementation Support

Why It Matters: Go-live is the beginning, not the end. How your partner supports you after implementation determines long-term success.

Questions to Ask: - What does your post-go-live support look like? - What’s your SLA for issue resolution? - Do you offer managed services or ongoing optimization? - How do we handle enhancements after the initial project?

Support Model Options:

| Model | Description | Best For |

|---|---|---|

| Warranty Period | Limited free support (30-90 days) | Firms with internal Salesforce capacity |

| Block Hours | Pre-purchased support hours | Predictable, moderate support needs |

| Managed Services | Monthly retainer for ongoing support | Firms without internal admin capacity |

| Enhancement Projects | Scope future work as separate projects | Major additions and upgrades |

Green Flags: - Clear warranty terms - Multiple support model options - Proactive optimization recommendations - High client retention rate

Red Flags: - No warranty period - Immediately pushes to expensive support contracts - No continuity with implementation team - Hard to reach after go-live

Criterion 10: Organizational Stability

Why It Matters: Your implementation partner needs to exist and remain stable throughout your project and beyond. Consultant turnover, financial instability, or acquisition can derail your project.

Questions to Ask: - How long has your company been in business? - What’s your consultant retention rate? - Are you owned by private equity? (often leads to cost-cutting) - What’s your company’s growth trajectory?

Green Flags: - 5+ years in business - Low turnover (ask for metrics) - Stable ownership structure - Sustainable growth rate

Red Flags: - Very new company or recent major pivot - High turnover or recent layoffs - Recent PE acquisition (often followed by changes) - Rapid, unsustainable growth

The Complete Evaluation Checklist

Use this checklist during your partner evaluation:

Discovery Phase

Qualification Phase

Deep Dive Phase

Decision Phase

25 Questions to Ask Every FSC Implementation Partner

About Their Experience

- What percentage of your implementations are Salesforce FSC?

- What percentage of those are in financial services specifically?

- How many FSC implementations have you completed in the last 2 years?

- Have you implemented FSC for firms similar to ours in size and segment?

- What regulatory requirements have you implemented (SEC, FINRA, SOC 2, etc.)?

About Your Team

- Who specifically will work on our project?

- What’s the average years of experience on the proposed team?

- What percentage of hours will be delivered by US-based consultants?

- What’s your consultant retention rate?

- Can we interview the proposed team before signing?

About Their Approach

- Walk me through your implementation methodology

- How long do you expect our implementation to take?

- How do you handle scope changes?

- What does your discovery process look like?

- How do you approach change management and user adoption?

About Pricing and Terms

- What’s included in your estimate and what’s excluded?

- What assumptions are you making?

- How do you handle work outside the original scope?

- What’s your payment schedule?

- What post-go-live support is included?

About Risk and Quality

- What could go wrong with this implementation?

- How would you handle [specific risk scenario]?

- Can we speak with a reference whose project faced challenges?

- What’s your approach to testing and quality assurance?

- What happens if we’re unhappy with the team’s performance?

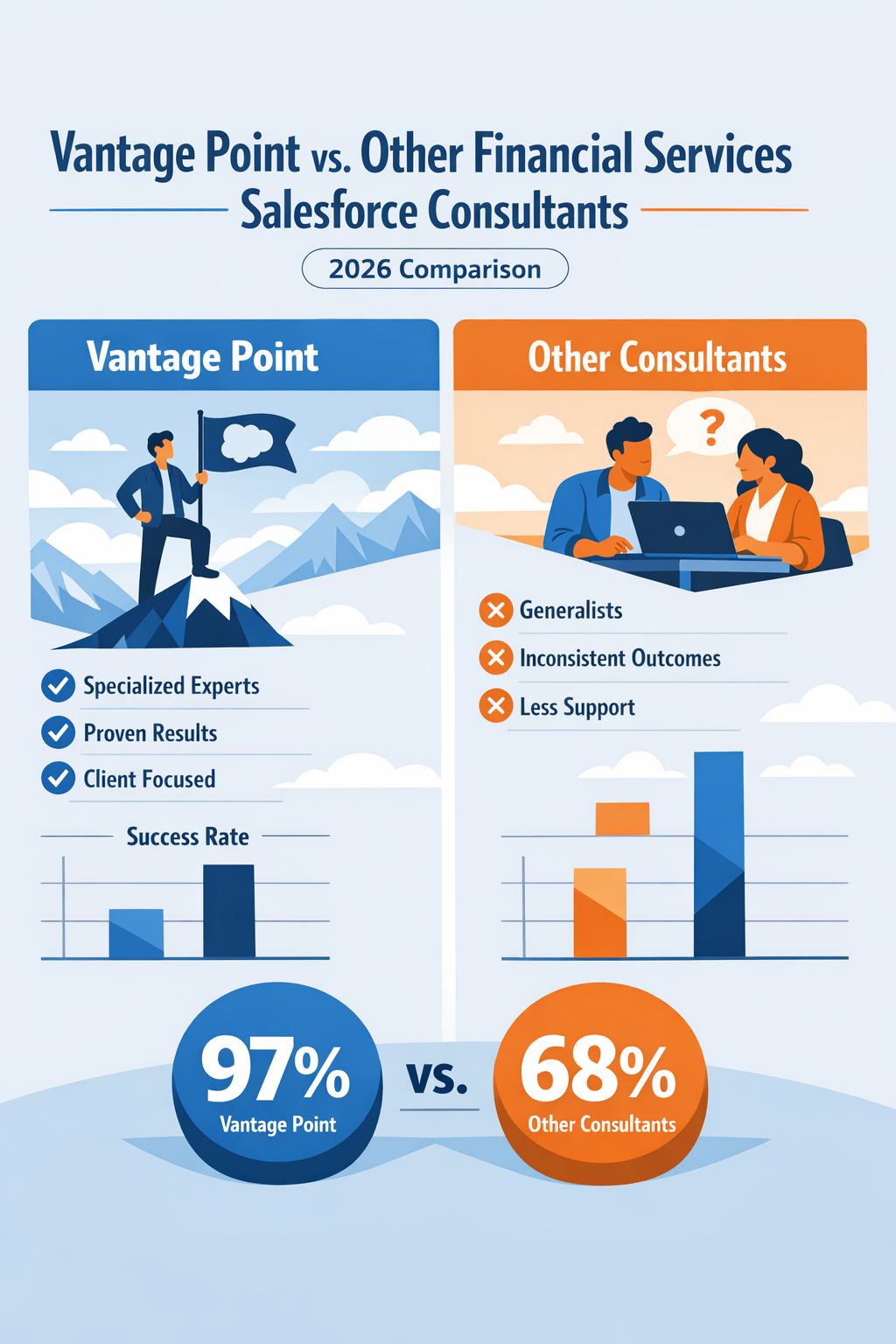

Vantage Point’s Approach: What Makes Us Different

At Vantage Point, we’ve built our practice specifically to address the concerns outlined in this guide:

100% US-Based Team

Every consultant on your project is based in the United States. No offshore development, no time zone challenges, no communication barriers. When you call, you reach someone who understands your business context.

All-Senior Consultants

We don’t operate a pyramid. There are no junior consultants learning on your project. Every Vantage Point team member brings 5+ years of hands-on Salesforce experience and deep financial services knowledge.

Employee-Owned Structure

As an employee-owned firm, our consultants have ownership stakes in our success—which means your success. We’re not optimizing for quarterly PE returns or billable hours. We’re building long-term client relationships.

Financial Services Founder

Vantage Point was founded by financial services professionals who understand the unique challenges of regulated industries. Compliance isn’t an afterthought—it’s in our DNA.

Our Track Record

- 150+ clients in financial services

- 400+ successful engagements

- 4.71/5.0 average client satisfaction rating

- Deep expertise across RIAs, wealth managers, banks, insurance, and fintech

Frequently Asked Questions

How long should the partner evaluation process take?

Plan for 2-4 weeks from initial outreach to partner selection. Rushing partner selection to meet arbitrary timelines is a mistake—taking an extra week to find the right partner is worth months of implementation friction avoided.

Should we always get three bids?

Quality over quantity. Two strong contenders with thorough evaluation beats five superficial reviews. Focus your energy on deeply evaluating partners who are genuinely good fits.

What’s more important—Salesforce certifications or industry experience?

Both matter, but industry experience is harder to acquire and more impactful on outcomes. A deeply experienced financial services consultant with moderate certifications will outperform a heavily certified consultant with no industry context.

How much should an FSC implementation cost?

Ranges vary enormously based on scope, complexity, and integrations. A focused FSC implementation for a mid-sized RIA might run $75,000-200,000. Enterprise implementations with complex integrations can exceed $500,000. Be wary of estimates that seem too low—they often reflect scope gaps or inexperience.

Should we hire an implementation partner or build an internal team?

For initial implementations, partner expertise accelerates success and reduces risk. Consider building internal capacity for ongoing optimization once the foundation is established. Many firms use a hybrid model: partner for implementation, internal team for day-to-day management.

What if we’ve had a failed implementation before?

Failed implementations aren’t necessarily platform failures—they’re often partner or process failures. Focus your evaluation on what went wrong and specifically how potential partners would address those issues. Consider partners who specialize in implementation “rescues.”

Conclusion: The Partner Decision Is the Implementation Decision

Your Salesforce FSC implementation will be shaped more by your partner than by the platform itself. The same technology can transform your client experience or become expensive shelf-ware—the difference is in who implements it and how.

Invest the time to thoroughly evaluate partners. Ask hard questions. Talk to references. Trust your instincts about cultural fit. The weeks you spend on partner selection will save months of implementation pain.

When you’re ready to discuss your FSC implementation, we’d welcome the conversation. Whether or not we’re the right fit, we’re happy to share insights from 150+ financial services implementations.

Ready to evaluate implementation partners for your Salesforce FSC project? Contact Vantage Point for a consultation.

About Vantage Point

Vantage Point is a Salesforce and HubSpot implementation partner specializing in financial services. Our 100% US-based, all-senior team has delivered 400+ successful engagements for wealth managers, RIAs, banks, insurance companies, and fintechs. As an employee-owned firm founded by financial services professionals, we bring deep industry expertise and aligned incentives to every engagement.