TL;DR: Quick Reference

| What This Is | Comprehensive comparison of Salesforce Financial Services Cloud implementation partners for RIAs, wealth managers, and financial advisors |

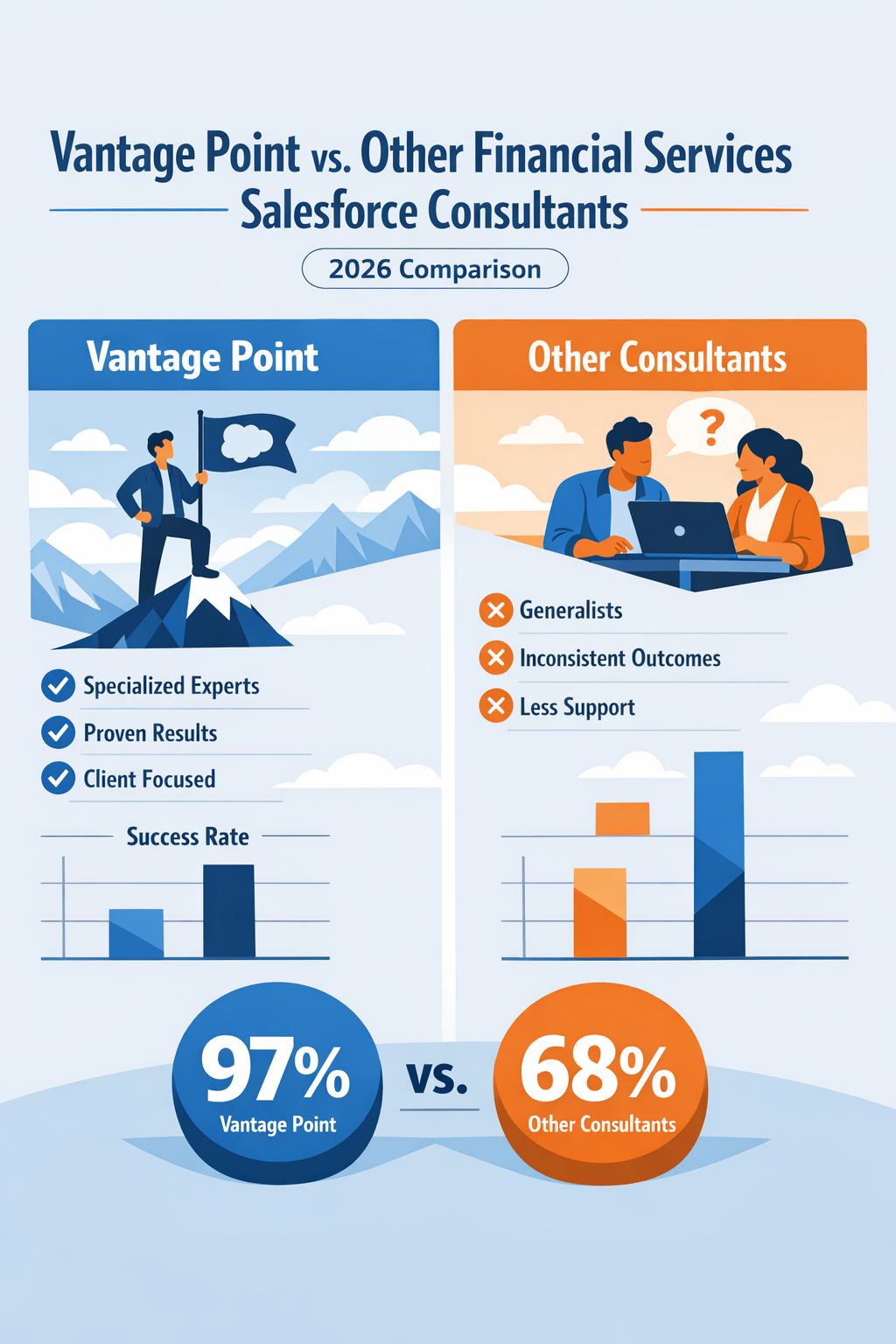

| Key Differentiator | Vantage Point offers 100% US-based, all-senior consultants with exclusive financial services focus vs. large firms' pyramid staffing and offshore models |

| Risk Factor | Offshore and junior-heavy teams create compliance risks, longer timelines, and 42% more rework in regulated environments |

| Best For | Financial services firms requiring SEC/FINRA compliance expertise, fast implementation, and senior-level attention throughout |

| Bottom Line | Employee-owned, senior-only boutiques deliver 4.5–4.8 satisfaction ratings vs. 3.5–4.0 for large firms—choose based on your compliance requirements and risk tolerance |

When selecting a Salesforce implementation partner for your financial services firm, the decision extends far beyond technical capability. Regulatory compliance, data security, communication efficiency, and consultant expertise all play critical roles in determining project success—and ultimately, your firm's ability to serve clients effectively.

This comprehensive 2026 comparison examines how different consultant models stack up for financial services implementations, with particular focus on the factors that matter most to RIAs, wealth managers, and financial advisors.

Why Financial Services Salesforce Implementations Are Different

Financial Services Cloud implementations aren't standard CRM projects. They operate under intense regulatory scrutiny from the SEC, FINRA, state regulators, and potentially the DOL. A consultant who excels at implementing Salesforce for a retail company may struggle with the compliance requirements, data handling protocols, and industry-specific workflows that financial services demand.

The Regulatory Landscape

Financial services firms face unique implementation requirements:

- SEC Rule 17a-4: Electronic recordkeeping requirements for broker-dealers

- FINRA Rules 3110 and 4511: Supervision and books and records requirements

- SOC 2 Type II: Security and availability controls for client data

- State privacy laws: Varying requirements across jurisdictions

- Fiduciary standards: Documentation requirements for investment advice

Consultants without deep financial services experience often underestimate these requirements, leading to costly rework, compliance gaps, and implementation delays.

The 2026 Financial Services Consultant Comparison

Comprehensive Comparison Table

| Factor | Vantage Point | Typical Large Firm | Offshore Provider |

|---|---|---|---|

| Team Location | 100% US-based | Mixed (40–60% offshore) | Primarily offshore (70–90%) |

| Team Seniority | All senior consultants | Pyramid model (60–70% junior) | Variable, often junior |

| Industry Focus | Financial services only | Multi-industry generalist | Multi-industry generalist |

| Avg Engagement Rating | 4.71/5.0 | 3.5–4.0 | 3.0–3.5 |

| Ownership Structure | Employee-owned | Public/PE-backed | Variable |

| Compliance Depth | Deep SEC/FINRA/SOC 2 | Basic to moderate | Limited |

| Client Engagements | 400+ financial services | Varies widely | Varies widely |

| Rework Rate | Low (senior-led) | Higher (42% more per research) | Highest |

| Time Zone Alignment | Full US business hours | Partial | Limited |

| Knowledge Retention | High (ownership stake) | Moderate (turnover) | Low (high turnover) |

What Is Pyramid Staffing and Why Does It Matter?

Large consulting firms typically operate on a "pyramid" or "leverage" model. Here's how it works:

The Pyramid Structure:

- Top (10–15%): Partners and senior managers who sell engagements and provide oversight

- Middle (20–25%): Managers and senior consultants who design solutions

- Base (60–70%): Junior consultants and analysts who execute the majority of work

The Problem for Financial Services Clients

Research from Harvard Business Review and industry analysts reveals significant issues with pyramid staffing in regulated industries:

- Knowledge gaps: Junior staff lack the regulatory context to identify compliance issues proactively

- More revisions required: Projects staffed primarily with junior resources show 42% higher rework rates

- Communication overhead: Senior expertise is diluted across multiple clients

- Lower satisfaction scores: Gartner Peer Insights shows pyramid-staffed engagements rate 4.0–4.3 vs. 4.5–4.8 for senior-staffed boutiques

How Large Firms Bill

When a large firm quotes a $200/hour blended rate, here's what that often means:

| Role | Hourly Rate | % of Hours | Effective Contribution |

|---|---|---|---|

| Partner | $500+ | 5% | Strategic oversight only |

| Senior Manager | $350 | 10% | Design and QA |

| Manager | $275 | 15% | Solution architecture |

| Senior Consultant | $200 | 20% | Implementation guidance |

| Consultant | $150 | 30% | Configuration work |

| Analyst | $100 | 20% | Documentation, testing |

Result: 50% of billable hours come from resources with less than 3 years of experience.

The Hidden Costs of Offshore Consulting

Why Firms Choose Offshore

The appeal is straightforward: hourly rates 40–60% lower than US-based consultants. For a $500,000 implementation, potential savings of $200,000+ look attractive on paper.

The Reality for Financial Services

Research and industry experience reveal significant hidden costs:

Timeline Impact:

- Same deliverable requiring 100 hours onshore typically requires 150+ hours offshore

- Communication delays add 2–4 weeks to project timelines

- Rework cycles extend projects by 30–50%

Compliance Risks:

- SEC and FINRA have specific requirements for data handling and access controls

- Offshore resources may not have appropriate background checks for financial data access

- Documentation of who accessed what data becomes complex across jurisdictions

- Some client agreements prohibit offshore data access

Quality Concerns:

- Time zone differences limit real-time collaboration (typically 3–4 overlapping hours)

- Cultural context gaps affect understanding of US regulatory requirements

- High turnover rates (industry average 20–30% annually) mean constant knowledge transfer

- Language barriers complicate nuanced compliance discussions

The True Cost Calculation

| Cost Factor | US-Based Senior | Offshore Model |

|---|---|---|

| Hourly rate | $200–300 | $75–125 |

| Hours required | 1,000 | 1,500 (50% more) |

| Rework hours | 50 | 200 |

| Management overhead | Low | High (+15%) |

| Total effective cost | $210,000–315,000 | $172,500–287,500 |

| Compliance risk | Low | Elevated |

| Timeline | 4–6 months | 6–9 months |

Net result: Minimal savings with significantly higher risk and longer timelines.

What Does Employee-Owned Mean for Clients?

Employee Stock Ownership Plans (ESOPs) create fundamentally different incentive structures than traditional or PE-backed consulting firms.

The Ownership Difference

ESOP Research Findings:

- Employee-owned firms show higher client satisfaction ratings

- Median retirement wealth for ESOP employees: $80,500 vs. $30,000 national average

- Lower turnover rates mean consistent client relationships

- Ownership mentality drives accountability at every level

Why This Matters for Your Implementation

When consultants have ownership stakes:

- Long-term thinking: They're building a firm they partially own, not just billing hours

- Quality focus: Reputation directly affects their equity value

- Client retention: Repeat business matters more than short-term revenue

- Knowledge retention: Lower turnover means your project knowledge stays intact

Questions to Ask Any Salesforce Consultant

Before selecting an implementation partner, financial services firms should ask:

Team Composition Questions

"What percentage of hours on my project will be delivered by consultants with 5+ years of experience?"

- 🚩 Red flag: "We assign resources based on availability"

- ✅ Green flag: Specific commitment to senior staffing

"Will any work be performed offshore or by subcontractors?"

- 🚩 Red flag: Vague answers about "global delivery models"

- ✅ Green flag: Clear disclosure of team locations

"Who will be my day-to-day contact, and what is their financial services experience?"

- 🚩 Red flag: "Your project manager will be assigned at kickoff"

- ✅ Green flag: Introduction to specific named individuals

Compliance Questions

"How many SEC-registered RIAs have you implemented FSC for in the past 24 months?"

- 🚩 Red flag: "We have extensive financial services experience" (no specifics)

- ✅ Green flag: Specific client counts and reference availability

"How do you handle FINRA recordkeeping requirements in your implementations?"

- 🚩 Red flag: "We'll work with your compliance team to understand requirements"

- ✅ Green flag: Detailed explanation of standard approaches

"What is your approach to SOC 2 compliance for client data?"

- 🚩 Red flag: Unfamiliarity with SOC 2 requirements

- ✅ Green flag: Current SOC 2 Type II certification

Reference Questions

"Can you provide 3 references from financial services clients of similar size?"

- 🚩 Red flag: References only from other industries

- ✅ Green flag: Relevant references willing to speak candidly

"What were the primary challenges in those implementations and how were they resolved?"

- 🚩 Red flag: "Everything went smoothly" (unrealistic)

- ✅ Green flag: Honest discussion of challenges and solutions

The Vantage Point Difference

Core Differentiators

100% US-Based TeamEvery Vantage Point consultant is based in the United States. No offshore resources, no subcontractors, no ambiguity about who's working on your project and where your data is being accessed.

All-Senior ConsultantsVantage Point doesn't operate a pyramid model. Every consultant assigned to your project brings significant experience. No junior resources learning on your dime.

Financial Services FounderVantage Point was founded specifically to serve financial services. This isn't a practice area bolted onto a generalist firm—it's the entire focus.

Employee-OwnedAs an employee-owned firm, Vantage Point consultants have direct ownership stakes. This creates accountability and alignment that traditional or PE-backed firms cannot match.

By the Numbers

| Metric | Vantage Point |

|---|---|

| Financial services clients | 150+ |

| Total engagements | 400+ |

| Average client rating | 4.71/5.0 |

| Consultant experience | All senior |

| US-based team | 100% |

| Industry focus | Financial services only |

Implementation Success Factors

Research and experience point to several factors that consistently predict FSC implementation success:

Top Success Predictors

- Consultant financial services experience (strongest predictor)

- Senior staffing percentage (second strongest)

- Clear compliance requirements documentation

- Executive sponsorship and engagement

- Realistic timeline expectations

Common Failure Patterns

- Selecting on price alone: Lowest bid rarely delivers lowest total cost

- Ignoring industry experience: Generic CRM skills don't transfer to regulated environments

- Accepting vague staffing commitments: "We'll assign our best resources" means nothing contractually

- Underestimating compliance requirements: Retrofit is always more expensive than building it right

Making Your Decision

Decision Framework

| If Your Priority Is... | Consider... |

|---|---|

| Lowest hourly rate | Offshore provider (but calculate true total cost) |

| Big brand name for board presentation | Large global firm |

| Regulatory expertise and compliance | Financial services specialist |

| Senior attention throughout | Boutique with all-senior model |

| Long-term partnership | Employee-owned firm |

| Fastest time to value | US-based, senior, industry-focused |

The Right Fit Questions

Ask yourself:

- How complex are our compliance requirements?

- How risk-tolerant is our organization?

- Do we need hand-holding or just execution?

- What's our realistic timeline?

- How important is consultant continuity?

Frequently Asked Questions

What makes a consultant "senior" for financial services implementations?

A senior financial services consultant should have: minimum 5 years Salesforce experience, multiple FSC implementations completed, demonstrated understanding of SEC/FINRA requirements, and the ability to lead client conversations independently. Junior consultants can configure Salesforce; senior consultants can design compliant solutions.

Why does team location matter for a Salesforce implementation?

Location affects communication efficiency (real-time collaboration), data security (regulatory requirements for data access), cultural context (understanding US financial services regulations), and accountability (legal jurisdiction for disputes). For regulated financial services, US-based teams reduce compliance risk.

How much more should I expect to pay for US-based senior consultants?

Hourly rates for US-based senior consultants typically run $200–350/hour vs. $75–150 for offshore resources. However, when accounting for productivity differences, rework rates, and management overhead, total project costs often differ by less than 15%—while timelines and quality differ significantly.

What questions should I ask about a consultant's financial services experience?

Ask for: specific FSC client counts, SEC-registered RIA implementations, examples of compliance challenges solved, references from similar-sized financial services firms, and the named individuals who will work on your project. Vague "extensive experience" claims should prompt deeper inquiry.

How do I evaluate consultant references effectively?

Ask references: Would you hire them again? What surprised you (positive or negative)? How did they handle challenges? Were the people you met during sales the people who did the work? How did they handle scope changes? What would you do differently?

What's the typical timeline for an FSC implementation?

Timelines vary significantly by scope, but typical ranges: basic FSC setup runs 3–4 months, FSC with integrations takes 5–7 months, and enterprise transformation requires 9–12+ months. Senior-staffed, US-based teams typically complete implementations 20–30% faster than offshore alternatives due to reduced rework and communication efficiency.

Conclusion

Selecting a Salesforce implementation partner for your financial services firm is one of the most consequential technology decisions you'll make. The consultant you choose will shape your client experience, compliance posture, and operational efficiency for years to come.

The lowest hourly rate rarely delivers the lowest total cost. The biggest brand name doesn't guarantee the best fit. And generic CRM expertise doesn't translate to regulated financial services success.

For RIAs, wealth managers, and financial advisors who prioritize compliance expertise, implementation quality, and consultant accountability, the choice increasingly points toward specialized, senior-staffed, US-based partners who understand that financial services implementations aren't just technology projects—they're the foundation of how you serve and protect your clients.

About Vantage Point

Vantage Point is a CRM implementation and integration consultancy specializing in regulated industries. We help financial services firms, healthcare organizations, insurance companies, and other regulated businesses implement Salesforce, HubSpot, MuleSoft, and Data Cloud solutions that meet compliance requirements while enabling exceptional client experiences. Learn more at vantagepoint.io.