The Paradox of Choice in Financial Technology

The financial technology landscape has never been more abundant—or more overwhelming. With over 26,000 fintech companies globally and the market projected to exceed $1.1 trillion by 2032, financial institutions face a paradox: unprecedented choice coupled with unprecedented complexity.

Choosing the wrong technology can result in:

- Wasted investment averaging $1.2 million for failed implementations

- Operational disruption lasting 6-18 months

- Competitive disadvantage as rivals advance

- Regulatory risk from inadequate compliance capabilities

- Staff frustration and talent attrition

Conversely, the right technology choice can transform your organization, delivering efficiency gains of 30-50%, enhanced client experiences, and sustainable competitive advantage.

At Vantage Point, we've guided 150+ organizations through 400+ Salesforce and HubSpot implementations. This experience has taught us that technology selection is as much about understanding your organization as it is about evaluating vendors. This guide provides a comprehensive framework for making informed decisions aligned with your strategic objectives.

Part 1: The Strategic Foundation

Before Evaluating Technology: Know Thyself

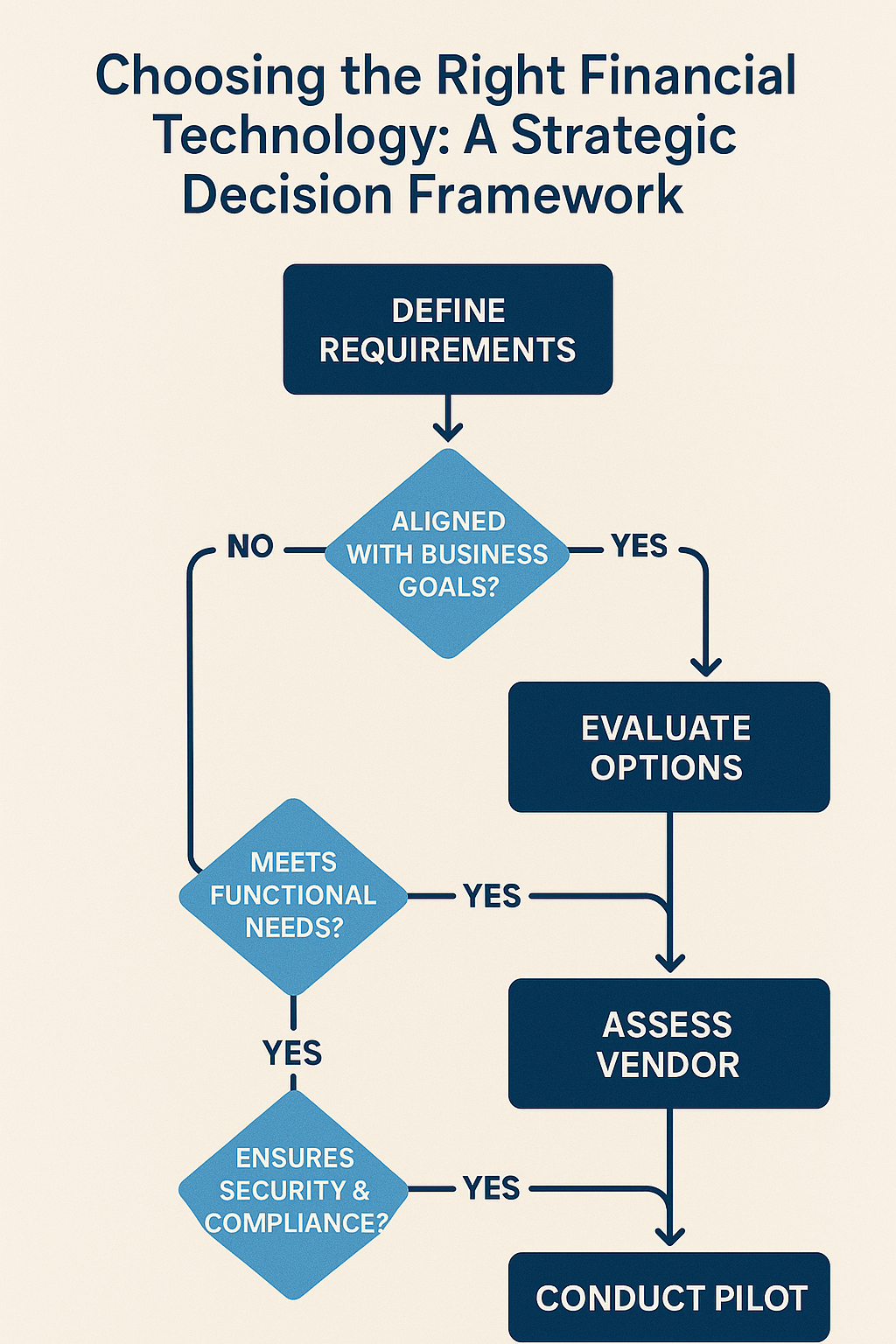

The most common mistake in technology selection is starting with the technology rather than the business need. This is why our methodology begins with People and Process before Technology. Before reviewing any vendor, complete this strategic assessment:

Organizational Readiness Assessment

Evaluate your organization across these seven critical dimensions:

Strategic Clarity — Do we have clear 3-5 year business objectives?

Process Maturity — Are our current processes documented and optimized?

Data Quality — Is our data clean, consistent, and accessible?

Change Capacity — Can our organization absorb significant change?

Technical Foundation — Do we have adequate infrastructure and IT capabilities?

Budget Alignment — Is there executive commitment to adequate investment?

Talent Availability — Do we have or can we acquire necessary skills?

Score each dimension from 1-5, then evaluate your total:

- 28-35: High readiness—proceed with confidence

- 21-27: Moderate readiness—address gaps before major initiatives

- 14-20: Low readiness—focus on foundational improvements first

- Below 14: Critical gaps—technology investment likely to fail without remediation

In our experience, organizations that score below 21 should invest in foundational improvements before pursuing major technology initiatives. We've seen too many implementations struggle not because of the technology, but because the organization wasn't ready.

Define Your Technology Vision

Answer these questions before engaging vendors:

What business outcomes must this technology enable?

- Revenue growth targets

- Cost reduction goals

- Client experience improvements

- Compliance requirements (FINRA, SEC, SOC 2)

- Competitive positioning

What is our integration philosophy?

- Best-of-breed (multiple specialized solutions)

- Platform consolidation (fewer, broader solutions)

- Hybrid approach

What is our risk tolerance?

- Proven, established solutions

- Innovative, emerging technologies

- Balanced portfolio

What is our realistic budget and timeline?

- Total cost of ownership over 5 years

- Implementation timeline constraints

- Resource availability

Part 2: The Financial Technology Landscape

Understanding Solution Categories

Financial technology spans numerous categories. Understanding where different solutions fit helps narrow your evaluation:

Core Systems: Core Banking, Portfolio Management, Trading Platforms, Accounting Systems, General Ledger

Engagement Platforms: CRM Systems, Client Portals, Marketing Automation, Communication Tools

Data & Analytics: Business Intelligence, Data Warehousing, Predictive Analytics, AI/ML Platforms

Operations & Compliance: Workflow Automation, Document Management, Compliance Management, Risk Management

Integration & Infrastructure: API Management, Middleware/iPaaS, Cloud Platforms, Security Solutions

Emerging Technologies: Blockchain/DLT, AI/Machine Learning, Open Banking, Embedded Finance

Key Platform Profiles

Based on our implementation experience across financial services, here's how the major platforms compare:

Customer Relationship Management (CRM)

Salesforce Financial Services Cloud — Best for enterprise wealth management and banking. Offers industry-specific features, robust ecosystem, and scalability, though at higher cost and complexity.

Microsoft Dynamics 365 — Ideal for Microsoft-centric organizations. Provides seamless Office integration and familiar interface, but less financial specialization.

HubSpot — Perfect for growth-stage firms with marketing focus. Extremely easy to use with integrated marketing tools, though limited financial features.

Wealthbox — Purpose-built for RIAs and small wealth managers. Affordable and advisor-focused, but limited scalability.

Redtail — Industry standard for independent advisors. Strong integrations but dated interface.

As Salesforce Certified Consultants and a HubSpot Solutions Partner, we have deep experience with both platforms and can help you determine which is right for your specific situation.

Portfolio Management & Reporting

Orion Advisor Services — Comprehensive solution for RIAs and wealth managers with strong integrations, though learning curve exists.

Black Diamond — High-net-worth focused with sophisticated reporting and client portal at premium pricing.

Tamarac — Unified platform for Envestnet ecosystem users with rebalancing capabilities and ecosystem lock-in considerations.

Addepar — Enterprise solution for ultra-high-net-worth clients and family offices with complex asset handling.

Morningstar Office — Research-oriented with exceptional data quality but less customization.

Financial Planning Software

eMoney Advisor — Comprehensive planning solution with depth of features and robust client portal.

MoneyGuidePro — Goal-based planning with intuitive interface for client engagement.

RightCapital — Modern platform for tech-forward firms with excellent user experience and competitive pricing.

Advyzon — All-in-one solution integrating CRM, planning, and billing with less specialized depth.

Holistiplan — Tax-focused planning with automated tax analysis.

Compliance & RegTech

ComplySci — Enterprise compliance solution that's comprehensive and scalable.

NRS (National Regulatory Services) — RIA compliance with industry expertise and outsourcing options.

SmartRIA — Affordable and user-friendly for small-mid RIAs.

Smarsh — Communication archiving with comprehensive capture and AI analysis.

ACA Group — Compliance consulting combined with technology.

For more on evaluating integration platforms, see our posts on API-Led Integration Revolutionizing Financial Services and Integrating FinTech with CRM Systems: A Practical How-To Guide.

Part 3: The Evaluation Framework

The STRATEGIC Evaluation Model

Use this comprehensive framework to evaluate any financial technology solution:

S - Scalability

Critical Questions:

- Can the solution grow with our business over 5-10 years?

- What are the user/data/transaction limits?

- How does pricing scale with growth?

- What is the vendor's track record with larger clients?

Evaluate across five key factors: user capacity headroom, data volume handling, performance at scale, pricing scalability, and architecture flexibility.

T - Technology Architecture

Critical Questions:

- Is the solution cloud-native or legacy with cloud wrapper?

- What is the API strategy and documentation quality?

- How frequently are updates released?

- What is the technology stack and its longevity?

Red Flags to Watch:

- Infrequent updates (less than quarterly)

- Poor or no API documentation

- Proprietary data formats

- Single-tenant architecture for cloud solutions

- End-of-life technology dependencies

R - Regulatory Compliance

Critical Questions:

- Does the solution support our specific regulatory requirements?

- What compliance certifications does the vendor hold?

- How quickly does the vendor respond to regulatory changes?

- What audit trail and reporting capabilities exist?

Essential Certifications:

- SOC 2 Type II (mandatory)

- ISO 27001 (recommended)

- PCI DSS (if handling payment data)

- GDPR compliance (if serving EU clients)

- FINRA/SEC compliance features (for financial services)

This is an area where we see many firms underestimate requirements. Compliance isn't just a checkbox—it's an ongoing operational need that your technology must support.

A - Adoption & Usability

Critical Questions:

- What is the learning curve for different user types?

- What training and support resources are available?

- How does the interface compare to consumer applications?

- What is the mobile experience?

Evaluation Method:

- Conduct hands-on demos with actual end users

- Request trial/sandbox access

- Check user reviews on G2, Capterra, industry forums

- Ask for references from similar organizations

Critical Insight: User adoption is the #1 factor in CRM success. The most feature-rich platform is worthless if your team won't use it. This is why our People, Process, Technology methodology prioritizes adoption from day one.

T - Total Cost of Ownership

Critical Questions:

- What are all cost components over 5 years?

- What is included vs. additional cost?

- How do costs compare to alternatives?

- What is the expected ROI timeline?

Calculate your complete TCO including Year 1 costs (software licensing, implementation services, data migration, integration development, training, internal staff time, hardware/infrastructure) and annual recurring costs for years 2-5 (licensing, support & maintenance, ongoing training, enhancements/customization).

For detailed cost breakdowns, see our Complete Financial Technology Integration Cost Calculator and explore Vantage Point's Salesforce Services for implementation options.

E - Ecosystem & Integration

Critical Questions:

- What native integrations exist with our current systems?

- What is the API capability for custom integrations?

- Is there a partner ecosystem for implementation support?

- What marketplace/app exchange options exist?

Assess each system you need to integrate: evaluate native availability, API quality, middleware needs, and complexity level.

For more on integration platforms, see our posts on Overcoming CRM Integration Challenges in Financial Services and Q2 Integration with Salesforce.

G - Growth & Innovation

Critical Questions:

- What is the vendor's product roadmap?

- How much does the vendor invest in R&D?

- What emerging technologies are being incorporated?

- How does the vendor gather and respond to customer feedback?

Innovation Indicators:

- Published product roadmap

- Regular feature releases

- AI/ML capabilities or roadmap

- Active user community

- Industry thought leadership

I - Implementation & Support

Critical Questions:

- What is the typical implementation timeline?

- What implementation methodology is used?

- What ongoing support options and SLAs exist?

- What is the vendor's customer success approach?

Evaluate support aspects including response times for critical and standard issues, support hours (24/7 or business hours), available channels (phone, chat, email), and whether dedicated customer success management is included.

C - Company Viability

Critical Questions:

- What is the vendor's financial stability?

- How long has the vendor been in business?

- What is the customer retention rate?

- Who are the investors/owners?

Assess risk across years in business, customer count, revenue trends, funding/ownership structure, and key client retention rates.

Part 4: The Selection Process

Phase 1: Discovery & Long List (Weeks 1-3)

Activities:

- Document requirements using the framework above

- Research market landscape

- Gather peer recommendations

- Create initial long list (8-12 vendors)

Deliverable: Requirements document and long list with initial screening scores

Phase 2: RFI & Short List (Weeks 4-6)

Activities:

- Issue Request for Information (RFI) to long list

- Score responses against requirements

- Narrow to short list (3-5 vendors)

- Schedule initial demonstrations

RFI Key Sections:

- Company background and financial stability

- Product capabilities and roadmap

- Implementation approach and timeline

- Pricing structure and TCO

- References from similar organizations

- Security and compliance certifications

Phase 3: Deep Evaluation (Weeks 7-10)

Activities:

- Conduct detailed demonstrations with use cases

- Complete hands-on trials/sandboxes

- Check references (minimum 3 per vendor)

- Perform security/compliance review

- Negotiate preliminary pricing

Demo Best Practices:

- Provide specific scenarios based on your workflows

- Include end users in demonstrations

- Ask vendors to use your sample data

- Request "day in the life" demonstrations

- Probe edge cases and exception handling

Phase 4: Final Selection (Weeks 11-12)

Activities:

- Complete final scoring

- Conduct executive presentations

- Negotiate final terms

- Make selection decision

- Develop implementation plan

Use a weighted decision matrix to score finalists across all STRATEGIC criteria, ensuring your evaluation is comprehensive and objective.

Part 5: Common Selection Mistakes to Avoid

Based on our experience across 400+ implementations, these are the mistakes we see most frequently:

Mistake 1: Feature Fixation

The Problem: Selecting based on feature count rather than fit

The Solution: Focus on features you'll actually use; 80% of users utilize only 20% of features

Mistake 2: Demo Deception

The Problem: Being swayed by polished demos that don't reflect reality

The Solution: Insist on hands-on trials with your data and scenarios

Mistake 3: Reference Bias

The Problem: Only speaking to vendor-provided references

The Solution: Find independent references through industry networks

Mistake 4: Cost Myopia

The Problem: Choosing the cheapest option without considering TCO

The Solution: Calculate full 5-year TCO including implementation, integration, and opportunity costs

Mistake 5: Integration Underestimation

The Problem: Assuming integrations will "just work"

The Solution: Validate integration capabilities with technical proof-of-concept

Mistake 6: Change Neglect

The Problem: Focusing on technology while ignoring organizational change

The Solution: Budget 15-20% of project cost for change management

Mistake 7: Vendor Lock-in Blindness

The Problem: Not considering exit strategy and data portability

The Solution: Ensure data export capabilities and understand contractual obligations

Part 6: Platform-Specific Insights

When to Choose Salesforce

Ideal For:

- Enterprise organizations with complex requirements

- Firms prioritizing ecosystem and integration breadth

- Organizations with dedicated Salesforce administration resources

- Companies planning significant customization

- Financial services firms needing Financial Services Cloud capabilities

Considerations:

- Higher total cost of ownership

- Requires skilled administration

- Can be over-engineered for simple needs

- Implementation partner quality varies significantly

Our Perspective: Salesforce excels when you need a platform that can evolve with complex, changing requirements. The investment pays off for organizations committed to leveraging the full ecosystem. We run our own operations on Salesforce, managing 400+ client engagements and tracking $50M+ in project pipeline—so we understand firsthand what it takes to succeed. Learn more about our Salesforce Services and Financial Services Cloud expertise.

When to Choose HubSpot

Ideal For:

- Growth-stage financial services firms

- Organizations prioritizing marketing and sales alignment

- Teams seeking rapid implementation

- Firms with limited technical resources

Considerations:

- Less depth in financial services-specific features

- May outgrow capabilities at enterprise scale

- Limited customization compared to Salesforce

- Marketing Hub pricing can escalate quickly

Our Perspective: HubSpot offers exceptional time-to-value for firms prioritizing inbound marketing and sales efficiency. The integrated approach reduces complexity but may require supplementation for specialized financial workflows. We use HubSpot alongside Salesforce in our own operations and can help you determine the right fit. Explore our HubSpot Commerce Hub services and see How to Connect HubSpot to Salesforce.

When to Choose Microsoft Dynamics 365

Ideal For:

- Microsoft-centric technology environments

- Organizations heavily using Office 365/Teams

- Firms seeking familiar user interface

- Companies with existing Microsoft enterprise agreements

Considerations:

- Financial services features less mature than Salesforce

- Implementation partner ecosystem smaller

- Can become complex with multiple modules

- Licensing model can be confusing

Our Perspective: Dynamics 365 makes sense when Microsoft integration is paramount and your requirements align with available modules. The familiar interface accelerates adoption for Microsoft-native organizations.

When to Choose Specialized Solutions

Ideal For:

- Firms with highly specific workflow requirements

- Organizations where depth trumps breadth

- Companies with strong integration capabilities

- Niche segments with purpose-built solutions

Considerations:

- Integration burden falls on you

- Vendor viability risk may be higher

- May require multiple point solutions

- Total ecosystem cost can exceed platforms

Our Perspective: Best-of-breed strategies work when you have the integration expertise to connect specialized solutions. The depth of functionality can provide competitive advantage in specific areas.

Part 7: Making the Final Decision

The Decision Framework

When scores are close, use these tiebreakers:

- Strategic Alignment: Which solution best supports your 5-year vision?

- Risk Profile: Which vendor presents the lowest implementation and viability risk?

- Cultural Fit: Which vendor's approach aligns with your organization's values?

- Reference Quality: Which vendor's customers are most similar and satisfied?

- Gut Check: After all analysis, which solution feels right?

Building Consensus

Technology decisions often involve multiple stakeholders with different priorities:

CEO/Executive — Focus on strategic value, ROI, and risk through business case and competitive impact

CFO/Finance — Address cost, budget, and ROI timeline with TCO analysis and payback calculation

COO/Operations — Emphasize efficiency, adoption, and support with process improvement metrics and training plans

CTO/IT — Provide technical assessment, security review covering architecture and integration

End Users — Demonstrate usability and daily workflow through hands-on demos and pilot programs

Compliance — Show regulatory requirements and audit capabilities through compliance mapping and certifications

Post-Selection Success Factors

Choosing the right technology is only the beginning. Ensure success with:

- Executive Sponsorship: Visible leadership commitment throughout implementation

- Dedicated Resources: Assign team members with protected time for the project

- Change Management: Invest in communication, training, and adoption support

- Realistic Timeline: Build in contingency; implementations typically take 20-30% longer than planned

- Success Metrics: Define and track KPIs from day one

- Continuous Improvement: Plan for ongoing optimization, not just go-live

Conclusion: Technology as Strategic Enabler

Choosing the right financial technology is one of the most consequential decisions a financial institution can make. The framework presented in this guide—grounded in strategic clarity, comprehensive evaluation, and disciplined process—provides a roadmap for making this decision with confidence.

Remember: The best technology is the one your organization will actually use effectively. Technical capabilities matter, but adoption, integration, and alignment with your strategic vision matter more.

The financial technology landscape will continue to evolve rapidly. By building internal capabilities for technology evaluation and selection, you position your organization to continuously adapt and thrive in an increasingly digital financial services industry.

Quick Reference: Technology Selection Checklist

Pre-Selection

- Completed organizational readiness assessment

- Defined clear business outcomes and success metrics

- Established realistic budget and timeline

- Identified key stakeholders and decision-makers

- Documented current technology landscape and integration requirements

Evaluation

- Created comprehensive requirements document

- Developed long list through research and peer input

- Issued RFI and scored responses

- Conducted detailed demonstrations with use cases

- Completed hands-on trials with actual users

- Checked references (minimum 3 per finalist)

- Performed security and compliance review

- Calculated 5-year TCO for finalists

Selection

- Completed weighted scoring matrix

- Conducted executive presentations

- Negotiated final terms and pricing

- Developed implementation plan

- Secured stakeholder sign-off

- Communicated decision to organization

Need Help With Your Technology Selection?

At Vantage Point, we help financial services firms—wealth advisory groups, credit unions, insurance companies, asset managers, and RIAs—navigate technology decisions with deep industry expertise and proven methodologies. We're 100% U.S.-based, employee-owned, and we practice what we preach by running our own operations on the same platforms we implement.

Whether you're evaluating Salesforce, HubSpot, or other financial technology solutions, we can help you:

- Assess organizational readiness

- Define requirements and success criteria

- Evaluate vendors objectively

- Plan and execute implementation

- Drive adoption and optimize performance

Schedule a Consultation to discuss your technology selection needs.

About Vantage Point

Vantage Point is a specialized Salesforce and HubSpot consultancy serving exclusively the financial services industry. We help wealth management firms, banks, credit unions, insurance providers, and fintech companies transform their client relationships through intelligent CRM implementations. Our team of 100% senior-level, certified professionals combines deep financial services expertise with technical excellence to deliver solutions that drive measurable results.

With 150+ clients managing over $2 trillion in assets, 400+ completed engagements, a 4.71/5 client satisfaction rating, and 95%+ client retention, we've earned the trust of financial services firms nationwide.

About the Author

David Cockrum, Founder & CEO

David founded Vantage Point after serving as COO in the financial services industry and spending 13+ years as a Salesforce user. This insider perspective informs our approach to every engagement—we understand your challenges because we've lived them. David leads Vantage Point's mission to bridge the gap between powerful CRM platforms and the specific needs of financial services organizations.