Transforming Salesforce workflows with intelligent automation that amplifies human expertise while meeting regulatory requirements

Artificial intelligence isn't coming to financial services—it's already here, quietly transforming how leading firms serve clients, manage operations, and compete in the market.

The question isn't whether to adopt AI. It's how to deploy it practically, compliantly, and profitably.

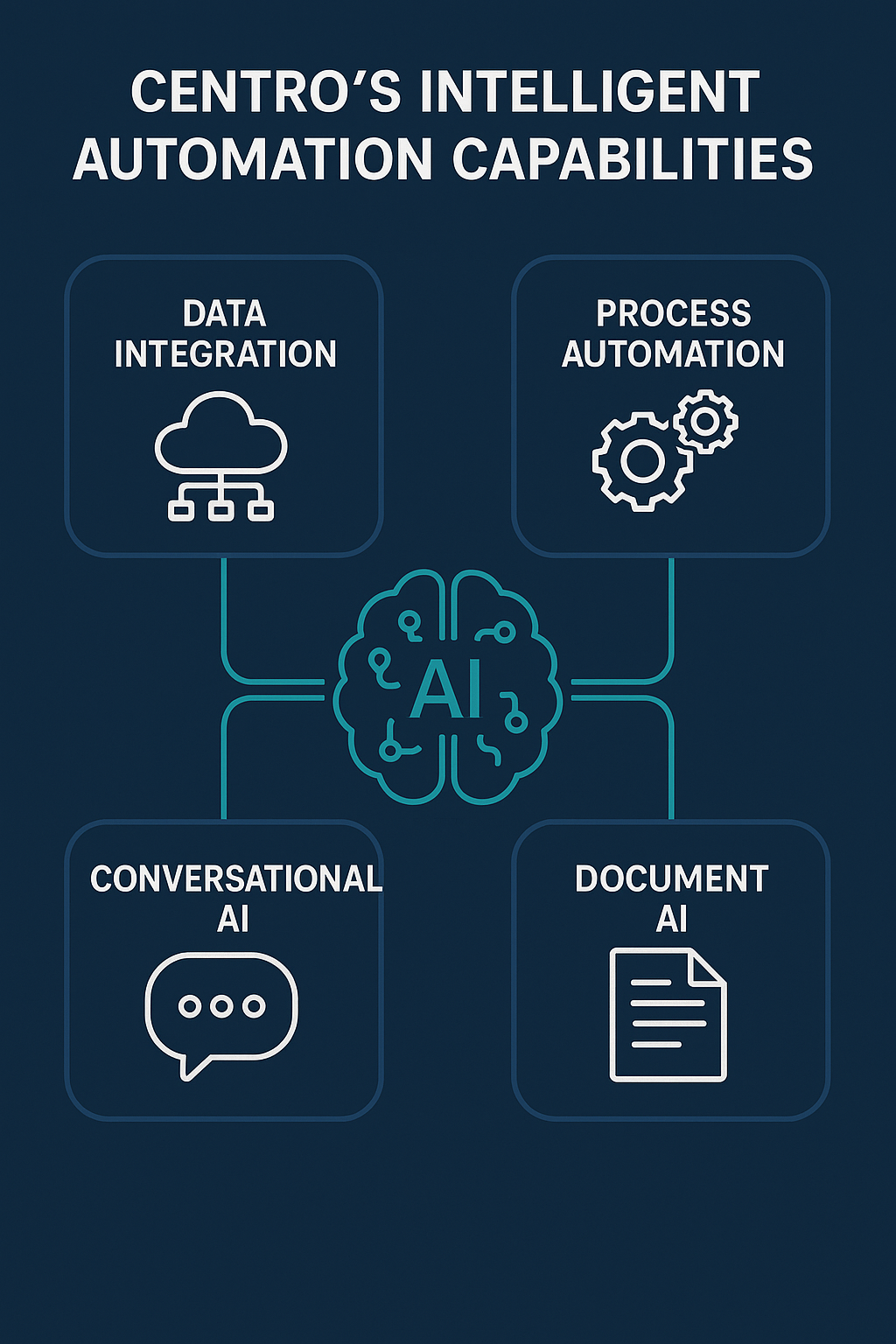

Centro has answered this question with a suite of AI-powered automation capabilities built specifically for CRM-driven workflows. Combined with Vantage Point's expertise in financial services implementation, these tools deliver immediate ROI while respecting the regulatory environment you operate within.

Today, we're exploring how intelligent automation amplifies human expertise—and why this matters urgently for wealth management, banking, insurance, and fintech firms.

Meet Centro: Your AI-Powered Collaboration Assistant

Centro's Centro AI assistant brings GPT-3 enterprise capabilities directly into your Salesforce-Slack-Teams workflows. This isn't experimental technology or a future roadmap item—it's deployed today in production environments across financial services.

Conversation Summarization

Conversation summarization transforms scattered discussions into structured insights. Your client service team spends hours in Slack channels discussing complex client situations. Centro analyzes these conversations and generates concise summaries highlighting key decisions, action items, and critical context. With one click, save this summary as a Salesforce record—complete documentation without manual note-taking.

Salesforce Integration

Salesforce integration preserves institutional knowledge. Team discusses a complicated claim scenario in Slack? Centro summarizes it and saves the summary to the relevant case record. Advisor team collaborates on financial planning strategy in Teams? AI captures the conversation thread as an activity on the household record. Knowledge that would typically evaporate into chat history becomes permanent CRM documentation.

AI Case Deflection

AI case deflection answers before asking. Traditional support models require customers to create tickets before receiving help. Centro's "Ask Centro AI" feature provides instant, generative answers before case creation. Customer asks a question, AI searches your knowledge base and Salesforce data, and delivers a comprehensive answer in seconds. Genuinely complex issues still become cases, but routine inquiries resolve immediately.

Knowledge Base Generation

Knowledge base generation happens automatically. As your team answers questions and solves problems in Slack/Teams, Centro identifies reusable solutions and drafts knowledge base articles. Administrators review and publish—institutional knowledge captured organically rather than through forced documentation processes.

Record-Based Queries

Record-based queries unlock Salesforce intelligence. "Show me all high-value clients who haven't been contacted in 60 days." "Find similar claims to this one." "What's the average resolution time for this issue type?" Ask Centro questions in natural language, and it queries Salesforce data intelligently, returning insights without requiring users to build reports.

Intelligent Automation in Action: Beyond Simple Workflows

Centro's AI doesn't just answer questions—it automates decision-making and orchestrates complex workflows with minimal human intervention.

Auto-Ticket Creation with Classification

Customer messages received in Slack or Teams are analyzed by AI to determine intent, urgency, and category. Is this a service request, product inquiry, complaint, or compliment? Does it require immediate attention or standard routing? AI makes these determinations automatically and creates appropriately classified Salesforce cases—routed to the right team with accurate metadata.

Smart Routing

Smart routing predicts optimal assignment. Traditional case routing uses rigid rules: "Product A goes to Team X." AI-powered routing considers multiple factors: case content, team member expertise, current workload, historical performance, and more. The result: cases assigned to team members most likely to resolve them quickly and effectively.

Sentiment Analysis

Sentiment analysis identifies priority situations. Not all urgent cases are marked urgent by customers. AI analyzes message sentiment to detect frustration, confusion, or dissatisfaction—even when the customer hasn't explicitly escalated. These cases receive priority handling before situations deteriorate. For wealth management firms, this means proactive outreach when clients express concern about markets or portfolios.

Pattern Recognition

Pattern recognition surfaces systemic issues. Individual support cases might seem isolated, but AI recognizes patterns across conversations. When multiple clients ask about the same feature, experience similar problems, or express related concerns, AI surfaces these trends to leadership. Product development teams receive actionable insights; operations leaders identify process improvements; relationship managers spot market sentiment shifts.

Proactive Nudges

Proactive nudges deliver context-aware alerts. Rather than overwhelming teams with notifications, AI determines which events truly require human attention. Case approaching SLA deadline? Nudge the owner. High-value client inquiry received? Alert the relationship manager immediately. Routine status update? No notification necessary. Context-aware intelligence reduces noise while ensuring critical information reaches the right people promptly.

Dashboard Intelligence

Dashboard intelligence transforms data into insight. Salesforce dashboards share metrics in Slack/Teams channels. But raw metrics aren't insights. Centro analyzes dashboard trends and generates natural language explanations: "Customer satisfaction dropped 5% this week, primarily driven by increased wait times in lending support." Teams understand not just what changed, but why and what to do about it.

Financial Services Applications: Where AI Delivers Immediate Value

Theory is interesting; application is valuable. Here's where Centro's AI capabilities solve real financial services challenges today.

Wealth Management: Advisor Intelligence

- Advisors ask Centro: "Summarize my client's last three interactions." AI provides instant context before client calls.

- Client sends message about portfolio concern; sentiment analysis flags for immediate advisor attention.

- Team discusses planning strategy for complex case; AI generates summary saved to household record for compliance.

- Knowledge base automatically populated with answers to common client questions about market volatility, tax strategies, or product features.

Banking: Customer Service Excellence

- Customer inquires about overdraft fee via chat; AI instantly provides policy explanation and resolution options—issue resolved in seconds without creating case.

- Complex product question automatically routes to specialized support team based on content analysis.

- Fraud alert generates case with AI-powered recommendation on response approach based on similar historical incidents.

- Support team conversations automatically analyzed to identify most frequent customer pain points, informing product development priorities.

Insurance: Claims Intelligence

- Policyholder files claim via Slack Connect; AI classifies claim type and routes to appropriate adjuster based on expertise match.

- Complex claim discussion among specialists summarized and saved to claim record—complete documentation for underwriting and compliance review.

- AI identifies claims with similar characteristics, suggesting precedent-based resolution approaches.

- Pattern recognition surfaces emerging fraud indicators across multiple seemingly-unrelated claims.

Fintech: Scaling Support Intelligently

- 80% of tier-1 support questions answered by AI deflection without requiring agent intervention (documented result).

- Product feedback from customer conversations automatically categorized and routed to development team.

- AI analyzes support trends to predict where product improvements would reduce support volume most significantly.

- New agent onboarding accelerated—AI provides instant access to institutional knowledge rather than shadowing senior agents for weeks.

Compliance: Automated Documentation

- All AI-assisted interactions logged to Salesforce with complete audit trail.

- Conversations automatically summarized and saved, creating compliance documentation organically.

- Potential regulatory issues flagged based on content analysis—proactive risk management.

- Training scenarios generated from anonymized actual cases—continuous team improvement.

Business Impact: Quantifying AI ROI

Centro customers document measurable outcomes from AI implementation:

- 35% case deflection rate: Over one-third of potential support cases resolved by AI before requiring agent intervention

- Near-instant response time: Seconds rather than hours for knowledge-base-available inquiries

- Knowledge capture multiplication: 5x increase in knowledge base article creation without additional labor

- Employee productivity surge: 6+ hours saved weekly per knowledge worker from instant access to information

- Customer satisfaction improvement: Faster, more accurate responses drive measurable CSAT gains

- Cost savings: Support capacity increased 40-60% without proportional staffing increases

The ROI Calculation

The ROI calculation is straightforward: if AI deflects 35% of cases, and your average case cost is $15 in labor, and you receive 10,000 cases monthly—that's $52,500 in monthly savings, or $630,000 annually. Centro AI add-on costs $30/user/month. For a 50-person support team, that's $18,000 annually.

ROI: 3,400%.

Even conservative assumptions yield compelling returns. And this calculation only captures case deflection—not productivity gains, knowledge capture, or customer satisfaction improvements.

AI Implementation: Practical and Compliant

Financial services firms rightfully approach AI cautiously. Regulatory considerations, data privacy, and accuracy concerns require thoughtful implementation.

Vantage Point's expertise ensures Centro AI deployment aligns with your compliance obligations:

- Supervised AI: Human review maintains appropriate oversight

- Audit trails: Complete documentation of AI-assisted decisions

- Explainability: Understanding how AI reached conclusions

- Data governance: Ensuring AI training data respects privacy rules

- Regulatory alignment: Configurations that meet SEC, FINRA, and state requirements

We don't implement AI because it's trendy. We implement it because it delivers measurable value while respecting the regulatory environment you operate within.

The Intelligent Future is Now

AI-powered automation isn't a future consideration—it's a present competitive advantage. Financial services firms deploying these capabilities today are demonstrating measurable improvements in efficiency, customer satisfaction, and employee experience.

Centro makes enterprise AI accessible through no-code implementation. Vantage Point ensures deployment aligns with financial services best practices and regulatory requirements.

Next week, we'll shift from capabilities to outcomes—diving deep into the business case for modern collaboration with detailed ROI frameworks you can use to justify investment to your CFO and executive team.

Ready to explore AI capabilities for your organization? Contact Vantage Point to schedule a consultation focused on AI-powered automation specific to your use cases.

Contact Vantage Point today to discover how Centro's AI can transform your operations.

About the Author

David Cockrum founded Vantage Point after serving as Chief Operating Officer in the financial services industry. His unique blend of operational leadership and technology expertise has enabled Vantage Point's distinctive business-process-first implementation methodology, delivering successful transformations for 150+ financial services firms across 400+ engagements with a 4.71/5.0 client satisfaction rating and 95%+ client retention rate.

-

-

- Email: david@vantagepoint.io

- Phone: (469) 652-7923

- Website: vantagepoint.io

-