Building AI That Actually Understands Wealth Management

Rolling out a major CRM update is one of the highest-risk, highest-reward activities in RevOps. Get it right, and you accelerate pipeline velocity. Get it wrong, and you create months of adoption friction and data chaos.

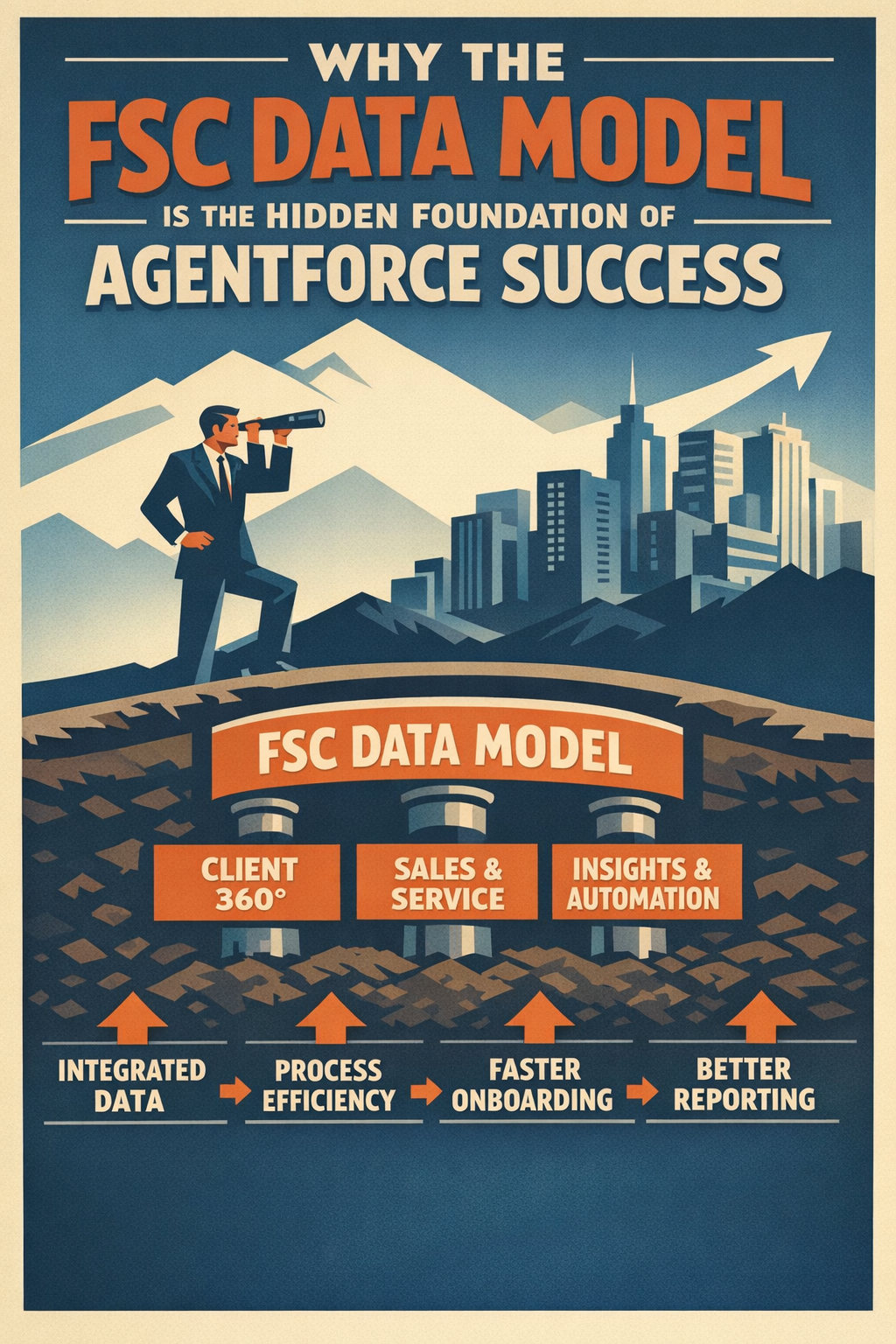

There's a conversation happening in boardrooms across wealth management and banking: Agentforce is the future, so why invest in Financial Services Cloud's data model?

It's a fair question. Salesforce's roadmap has clearly pivoted toward Agentforce as the flagship innovation for financial services. The pre-built AI agent templates—Financial Advisor Assistants, Banking Service Agents, Digital Loan Officers—have captured attention and budget alike.

But here's what that conversation often misses: Agentforce doesn't replace FSC's data model. It depends on it.

The firms that will scale AI successfully aren't those rushing past the data model to deploy agents faster. They're the ones recognizing that FSC's industry-specific architecture is exactly what makes Agentforce powerful in the first place.

What Is the FSC Data Model, Really?

When people discuss Financial Services Cloud, they often think of it as "Salesforce for financial advisors"—a CRM with some industry-specific features. That's true, but it dramatically undersells what FSC actually provides.

At its core, FSC delivers a purpose-built data architecture designed specifically for the complexity of financial relationships.

Beyond Standard CRM Objects

Where standard Salesforce gives you Accounts, Contacts, and Opportunities, FSC adds:

- Financial Account Object — Segmented by product type (checking, savings, investments, loans, insurance policies)

- Household & Group Management — Unified views across family members with rollup calculations

- Actionable Relationship Center (ARC) — Visual mapping of complex client-advisor-product relationships

- Interaction Tracking — Complete audit trails of every client touchpoint

- Financial Goals — Structured tracking of client objectives tied to accounts and strategies

The Architecture Evolution

FSC has evolved significantly since its 2016 launch as a managed package. Today, it's a core platform integration, meaning:

- Features like Financial Goals, Households, and Rollups are embedded directly into Salesforce's foundation

- Updates align with Salesforce's regular release cycles

- Industry-specific capabilities are available without complex installations

This isn't just technical housekeeping. It's the foundation that makes scalable AI possible.

Why Agentforce Needs FSC's Data Model

Here's the reality that Salesforce's marketing doesn't always make explicit: Agentforce agents are only as intelligent as the data they can access.

When Salesforce describes Agentforce for Financial Services, they emphasize that it's "grounded in a firm's data, workflows, and compliance controls." That grounding? It's FSC's data model.

The Intelligence Gap

Consider what happens when a Financial Advisor Assistant agent prepares for a client meeting:

With FSC's Data Model:

- The agent accesses the Financial Account object to see portfolio positions across all accounts

- It pulls household data to understand family relationships and combined AUM

- It reviews interaction history to surface recent conversations and action items

- It identifies financial goals to suggest relevant talking points

- It checks related accounts (spouse's IRA, children's 529 plans) for comprehensive preparation

Without FSC's Data Model:

- The agent sees a contact record with basic information

- Custom fields may exist, but without standard relationships

- Household connections require custom development to surface

- Portfolio data lives in disconnected systems or flat text fields

- Meeting prep becomes a generic CRM summary, not financial insight

The difference isn't incremental. It's the difference between an agent that understands wealth management and one that understands contact management.

Pre-Built Actions Require Pre-Built Objects

Agentforce's power comes from its pre-built Topics and Actions—the industry-specific behaviors that let agents handle tasks like:

- Generating meeting agendas with portfolio context

- Processing fee reversals within compliance limits

- Surfacing loan options based on client financial profiles

- Creating follow-up tasks tied to specific financial accounts

These actions don't operate in a vacuum. They're designed to interact with FSC's standard objects. When Agentforce creates a follow-up task after a client meeting, it links that task to the correct Financial Account, Household, and Interaction records. When it suggests talking points, it queries the Financial Goals object for context.

Firms that skip FSC's data model and build custom architectures often discover they're also rebuilding every Agentforce action from scratch—defeating the purpose of pre-built AI agents.

The Innovation Shift: FSC Is Now the AI Foundation

Yes, it's true: FSC-specific feature innovation has slowed compared to Salesforce's early years. But that's not because Salesforce abandoned financial services—it's because they repositioned FSC as the foundation for AI innovation rather than the destination.

Recent FSC Releases Focus on AI Enablement

Look at what Financial Services Cloud releases have actually prioritized:

Summer '25 Release:

- Pre-built role-based AI agents for wealth management, banking, and insurance

- Process Compliance Navigator for AI governance

- Automated post-meeting actions for relationship managers

Winter '26 Release:

- Meeting agenda generation

- Action plan automation

- Enhanced advisor productivity tools through Agentforce

The theme is clear: FSC development now focuses on making the platform AI-ready, not adding standalone features. The data model itself is stable because it works—and because changing it would break the AI agents built on top of it.

The Platform Infrastructure Advantage

FSC's architecture provides several AI-critical capabilities that aren't obvious from feature lists:

Metadata-Driven Architecture: FSC's metadata approach means AI agents can understand relationships between objects without hard-coded logic. An agent querying "client accounts" automatically inherits the financial account hierarchy, household rollups, and product segmentation—no custom development required.

Einstein Trust Layer Integration: FSC's data model integrates with Salesforce's Einstein Trust Layer, which uses metadata to detect and mask sensitive fields before AI processing. Financial account numbers, SSNs, and PII are protected at the architecture level, not through post-hoc security patches.

Compliance Framework Embedding: When Agentforce actions process fee reversals or loan recommendations, they operate within FSC's built-in compliance workflows. Approvals, disclosures, and audit trails are structural, not optional add-ons.

What This Means for Your AI Strategy

If your firm is evaluating Agentforce—or already deploying it—the FSC data model question isn't philosophical. It's practical.

Assessment Questions to Ask

1. Where does your client financial data actually live?

If it's in custom objects, flat fields, or external systems without FSC integration, Agentforce agents won't be able to leverage it intelligently. The data exists, but the AI can't use it.

2. How are household relationships modeled?

Agentforce's meeting prep and client insight features assume household and group structures. Without FSC's household model, agents lose the ability to understand family wealth holistically.

3. What compliance workflows exist for AI actions?

FSC's Process Compliance Navigator provides guardrails for AI agent actions. Without it, firms must build compliance logic manually—creating risk and slowing deployment.

4. Are you planning to use pre-built Agentforce templates?

If yes, FSC's data model is effectively required. The Financial Advisor Assistant, Banking Service Agent, and Loan Officer templates are designed for FSC objects. Adapting them to custom architectures typically costs more than implementing FSC properly.

The Build vs. Buy Calculation

Some firms consider building custom data architectures that mirror FSC's structure without licensing FSC itself. This approach rarely pencils out when AI is the goal:

| Factor | Custom Build | FSC Implementation |

|---|---|---|

| Initial Development | $200K-$800K+ | $50K-$300K |

| Agentforce Compatibility | Requires custom integration | Native |

| Pre-Built AI Actions | Must rebuild each action | Included |

| Compliance Framework | Must develop and maintain | Maintained by Salesforce |

| Ongoing Updates | Self-supported | Quarterly releases |

The math changes when AI scalability enters the equation. Building a custom data model might seem cheaper until you realize every Agentforce enhancement requires parallel custom development.

Practical Next Steps

For Firms Not Yet on FSC

1. Conduct a Data Model Assessment

Map your current Salesforce architecture against FSC's standard objects. Identify gaps in financial account modeling, household structure, and relationship tracking.

2. Prioritize High-Impact Objects

You don't need to implement every FSC feature at once. Start with Financial Accounts and Households—the objects most critical for Agentforce intelligence.

3. Plan Integration Before AI Deployment

Resist the pressure to deploy Agentforce agents before your data model is ready. Agents deployed on incomplete data create poor client experiences that are harder to fix than starting correctly.

For Firms Already on FSC

1. Audit Data Quality

Your data model may be correct, but is your data clean? Agentforce agents surface whatever data exists—including duplicates, outdated records, and inconsistencies.

2. Validate Household Relationships

Review your household and group configurations. Are relationships accurately modeled? Are rollup calculations correct? AI agents will expose any gaps to advisors during meeting prep.

3. Assess Compliance Readiness

Review FSC's Process Compliance Navigator capabilities against your firm's requirements. Configure appropriate guardrails before enabling AI agent actions.

The Bottom Line

Financial Services Cloud's data model isn't a legacy system waiting to be replaced by AI. It's the foundation that makes AI in financial services actually work.

Salesforce's innovation focus has shifted to Agentforce—that's undeniable. But Agentforce for Financial Services is explicitly built on FSC's architecture. The pre-built agents, the compliance frameworks, the industry-specific actions—all of it assumes FSC's data model is in place.

Firms that skip the data model to chase AI faster typically find themselves building custom foundations that cost more and deliver less. The smarter path is recognizing that FSC investment isn't separate from AI strategy. It IS AI strategy.

The question isn't whether to invest in FSC or Agentforce. It's whether you want AI agents that understand wealth management—or AI agents that just understand contact management.

How Vantage Point Can Help

At Vantage Point, we specialize in helping financial services firms build the data foundations that make AI successful. Whether you're implementing FSC for the first time, optimizing an existing deployment, or preparing for Agentforce, our team brings deep expertise in:

- Financial Services Cloud implementation and optimization

- Data model assessment and migration

- Agentforce readiness evaluation

- Integration with core wealth management and banking systems

Ready to build your AI-ready data foundation? Contact Vantage Point to discuss your Salesforce and Agentforce strategy.

Frequently Asked Questions

Is Financial Services Cloud required for Agentforce?

Technically, no—Agentforce can run on standard Salesforce. However, Agentforce for Financial Services (the pre-built agent templates for wealth management, banking, and insurance) is designed for FSC's data model. Using these agents without FSC requires significant custom development.

Has Salesforce stopped developing Financial Services Cloud?

No. FSC development has shifted focus from standalone features to AI enablement. Recent releases prioritize making FSC the foundation for Agentforce rather than adding disconnected capabilities.

Can we implement Agentforce first and FSC later?

This approach typically creates more work, not less. Agents deployed without FSC's data model produce generic outputs. Retrofitting FSC later means re-training agents and fixing client-facing issues.

What's the minimum FSC implementation needed for Agentforce?

At minimum, Financial Accounts and Household objects should be properly implemented with clean data. Interaction tracking and Financial Goals significantly improve agent intelligence for meeting prep and client insights.

How long does FSC implementation take?

Timelines vary based on data migration complexity and integration requirements. Typical implementations range from 3-6 months for mid-size firms. Vantage Point's assessment process helps establish realistic timelines based on your specific situation.

About the Author

David founded Vantage Point after serving as COO in the financial services industry and spending 13+ years as a Salesforce user. This insider perspective informs our approach to every engagement—we understand your challenges because we've lived them. David leads Vantage Point's mission to bridge the gap between powerful CRM platforms and the specific needs of financial services organizations.

David Cockrum is the founder of Vantage Point and a former COO in the financial services industry. Having navigated complex CRM transformations from both operational and technology perspectives, David brings unique insights into the decision-making, stakeholder management, and execution challenges that financial services firms face during migration.

-

-

- Email: david@vantagepoint.io

- Phone: (469) 499-3400

- Website: vantagepoint.io

-