How to Navigate Technical Complexity and Organizational Change for Integration Success

Your CRM implementation has been running for years. It houses valuable customer data, tracks sales activities, and supports your team's daily operations. But as your firm grows and client expectations evolve, you're noticing gaps: manual processes that don't scale, missed opportunities, inconsistent follow-up, and difficulty measuring marketing's true impact on revenue.

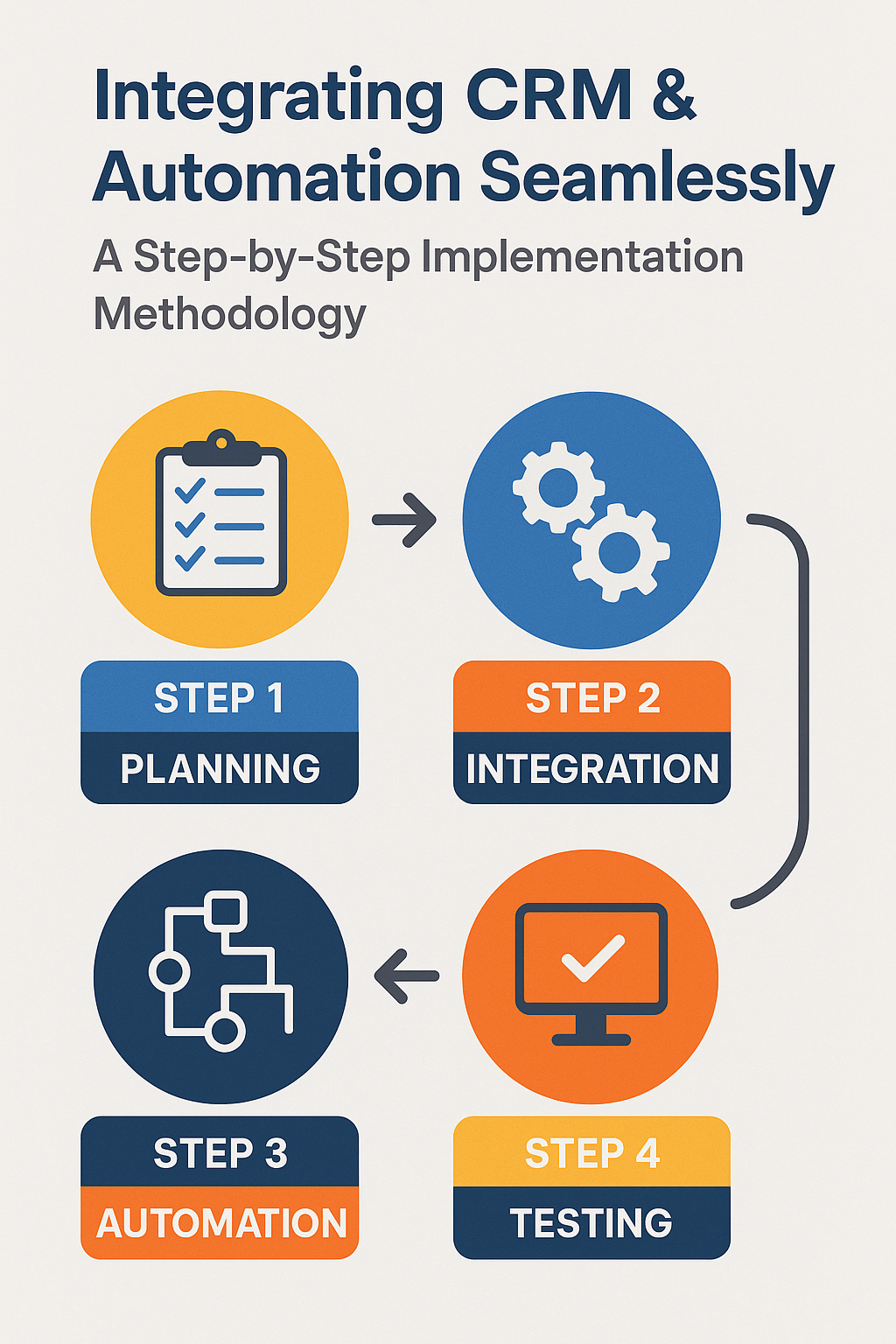

Integrating CRM systems with marketing automation platforms is a transformative initiative that can revolutionize how financial services firms engage with clients. However, the technical complexity, organizational change management, and strategic considerations involved make this a high-stakes project that requires careful planning and execution.

This comprehensive methodology provides a proven, step-by-step framework that financial services firms can follow to achieve seamless CRM and marketing automation integration. Based on successful implementations across the industry—including over 400 successful engagements with financial services firms—this approach minimizes risk, accelerates time-to-value, and ensures long-term success through strategic planning and disciplined execution.

Pre-Integration Phase: Assessment and Planning

Step 1: Establish Project Foundation (Week 1)

1.1 Define Business Objectives

Begin by articulating clear, measurable goals that integration should achieve. Common objectives for financial services firms include:

- Operational Efficiency: Reduce manual data entry by 80% and free up 10+ hours per sales rep weekly

- Lead Quality: Improve lead-to-opportunity conversion rate by 35%

- Revenue Growth: Increase closed deals by 25% through better nurturing and timing

- Client Experience: Deliver personalized communications at scale to 5,000+ contacts

- Compliance: Ensure automated systems meet regulatory requirements (SEC, FINRA, GDPR)

Document these goals in a project charter with executive sponsorship and success criteria.

1.2 Assemble Cross-Functional Team

Successful integration requires collaboration across multiple departments:

| Role | Responsibilities | Time Commitment |

|---|---|---|

| Executive Sponsor | Remove roadblocks, approve budget, resolve conflicts | 2-3 hours/week |

| Project Manager | Coordinate activities, track progress, manage timeline | Full-time |

| CRM Administrator | Configure Salesforce/CRM, manage data model | 20+ hours/week |

| Marketing Operations | Set up automation platform, build campaigns | 20+ hours/week |

| IT/Security Lead | Ensure compliance, manage integrations, security review | 10-15 hours/week |

| Sales Manager | Define workflows, provide user perspective, champion adoption | 5-10 hours/week |

| Customer Success Rep | Input on client lifecycle, retention workflows | 5 hours/week |

| Data Analyst | Reporting requirements, measure success metrics | 5-10 hours/week |

Schedule weekly project meetings and establish communication channels (Slack, Teams, project management tool).

1.3 Conduct Current State Assessment

Audit your existing systems and processes:

Technical Inventory:

- CRM platform and version

- Current integrations and data sources

- Custom fields and objects

- User permissions and security model

- Data volume (number of records, storage usage)

Process Documentation:

- Lead lifecycle and handoff procedures

- Sales methodology and stages

- Marketing campaign workflows

- Reporting and analytics requirements

Data Quality Analysis:

- Run duplicate detection reports

- Assess field completeness rates

- Identify data inconsistencies

- Review historical data cleanup needs

User Feedback:

- Survey sales and marketing teams on pain points

- Document wish-list features and capabilities

- Identify resistance areas and concerns

Step 2: Design Future State Architecture (Week 2)

2.1 Select Marketing Automation Platform

If not already chosen, evaluate platforms based on criteria relevant to financial services:

Evaluation Criteria:

- Compliance Features: FINRA archiving, audit trails, consent management

- CRM Integration: Native vs. third-party connectors, sync capabilities

- Scalability: Support for contact volume and data complexity

- Ease of Use: User interface, training requirements, technical expertise needed

- Pricing: Total cost of ownership including add-ons and professional services

- Security: SOC 2 Type II compliance, data encryption, access controls

Leading Platforms for Financial Services:

- HubSpot: User-friendly, strong inbound marketing, good for small-to-mid size firms

- Marketo: Enterprise-grade, advanced capabilities, higher complexity

- Pardot (Salesforce): Native Salesforce integration, good for existing SF customers

- ActiveCampaign: Affordable, solid automation, growing in financial sector

2.2 Map Data Architecture

Create detailed documentation of how data will flow between systems:

Object-Level Mapping:

| Marketing Automation | CRM | Sync Direction | Notes |

|---|---|---|---|

| Contact | Lead | Bidirectional | Creates Lead if no existing match |

| Contact | Contact | Bidirectional | Updates existing Contact records |

| Company | Account | Bidirectional | Company domain = matching key |

| Deal/Opportunity | Opportunity | Bidirectional | Full pipeline sync |

| List Membership | Campaign Member | MA → CRM | Marketing campaign attribution |

| Form Submission | Task/Activity | MA → CRM | Log engagement activities |

Field-Level Mapping:

Document every field that will sync, including:

- Source system (which platform is authoritative)

- Sync direction (one-way or bidirectional)

- Conflict resolution (if both systems update same field)

- Data transformations (formatting, picklist mappings)

Example Field Mapping:

| MA Field | CRM Field | Direction | Authority | Notes |

|---|---|---|---|---|

| Two-way | Most recent update | Primary unique identifier | ||

| First Name | FirstName | Two-way | Most recent update | Standardize capitalization |

| Last Name | LastName | Two-way | Most recent update | Standardize capitalization |

| Company | Company | MA → CRM | MA | From form submissions |

| Lead Score | Lead_Score__c | MA → CRM | MA | Calculated in automation platform |

| Lifecycle Stage | Lead_Status__c | Two-way | MA | Mapped to CRM picklist values |

| Owner | Owner | CRM → MA | CRM | For personalized email sending |

2.3 Design Lead Management Framework

Define how leads will flow through your integrated system:

Lead Lifecycle Stages:

- Subscriber: Opted in but not yet engaged (scored 0-24 points)

- Lead: Showing early interest (25-49 points)

- Marketing Qualified Lead (MQL): Meets criteria for sales attention (50-99 points)

- Sales Accepted Lead (SAL): Sales agrees to work the lead (CRM status = Working)

- Sales Qualified Lead (SQL): Verified fit and intent (100+ points, opportunity created)

- Opportunity: Active sales process (Opportunity stages)

- Customer: Closed/won (Account with active relationship)

- Evangelist: Promoter and referral source (NPS 9-10)

Lead Scoring Model:

Demographic Scoring (Firmographic Fit):

- Ideal company size: +30 points

- Target industry: +25 points

- Decision-maker title: +25 points

- Geographic match: +10 points

Behavioral Scoring (Engagement):

- Email open: +2 points

- Email click: +5 points

- Website visit: +3 points

- Content download: +15 points

- Pricing page view: +20 points

- Demo request: +50 points

Negative Scoring (Disqualifiers):

- Student email domain: -50 points

- Competitor: -100 points

- Unsubscribe: -25 points

Score Decay:

- Decrease by 5 points every 30 days without engagement

Handoff Triggers:

- Reach 50 points → Change stage to MQL, create CRM task for SDR

- Reach 100 points → Change stage to SQL, assign to account executive, send alert

- Form submission requesting contact → Immediate notification regardless of score

2.4 Document Integration Requirements

Create technical specifications:

API Requirements:

- CRM API access enabled

- Marketing automation API limits understood

- Dedicated integration user accounts created

- Authentication methods (OAuth, API keys) determined

Sync Frequency:

- Real-time for high-priority data (form submissions, hot leads)

- Every 15 minutes for standard updates (scores, activities)

- Nightly batch for large data loads (historical imports)

Error Handling:

- Define acceptable error rate thresholds

- Establish monitoring and alerting protocols

- Create procedures for investigating and resolving sync failures

Security and Compliance:

- Data encryption in transit (TLS/SSL)

- Data encryption at rest

- Access control and user permissions

- Audit logging requirements

- Data retention policies

- GDPR/CCPA compliance for consent management

Implementation Phase: Build and Configure

Step 3: Prepare Data for Integration (Week 3)

3.1 Execute Data Cleanup

Clean data before integration to avoid perpetuating problems:

Duplicate Removal:

- Run CRM duplicate detection (merge based on email as unique ID)

- Deduplicate company/account records (use domain matching)

- Remove test and employee records

- Consolidate records with similar names/emails

Standardization:

- Phone numbers: Convert to consistent format (e.g., +1-555-123-4567)

- State/province codes: Use standard abbreviations (CA, NY, not California)

- Company names: Remove Inc., LLC, etc. for matching consistency

- Job titles: Standardize common variations (CEO vs Chief Executive Officer)

Field Completion:

- Identify required fields for integration (email, company, owner)

- Fill gaps through research or enrichment services

- Set up validation rules to enforce completeness going forward

3.2 Enrich Existing Data

Enhance records with additional information:

Third-Party Enrichment:

- Use services like Clearbit, ZoomInfo, or Dun & Bradstreet

- Append firmographic data (company size, revenue, industry)

- Add technographic data (systems and tools they use)

- Populate social media profiles

Historical Activity Import:

- Export past email interactions from CRM

- Import into marketing automation platform for historical context

- Tag with source and date to distinguish from new activities

Step 4: Install and Configure Integration (Week 4)

4.1 Technical Installation

Follow platform-specific integration procedures:

For HubSpot-Salesforce Integration:

- In HubSpot:

- Navigate to Settings → Integrations → Connected Apps

- Search for Salesforce and click "Connect app"

- Authenticate with Salesforce integration user credentials

- In Salesforce:

- Install HubSpot managed package from AppExchange

- Select "Install for All Users"

- Grant necessary permissions (API access, object permissions)

- Wait for installation to complete (5-10 minutes)

- Return to HubSpot:

- Configure object mappings (Contacts, Companies, Deals)

- Set sync direction for each object

- Map custom fields

- Choose activity sync settings

- Add Visualforce Components (Optional):

- Install HubSpot embed window in Salesforce page layouts

- Allows viewing HubSpot activity timeline within Salesforce records

For more detailed technical guidance on automating financial services workflows with Salesforce and HubSpot, including custom object creation and advanced integration configurations specific to financial services needs, specialized resources are available.

4.2 Configure Field Mappings

Follow your mapping document created in Step 2.2:

- Map standard fields first (Name, Email, Company)

- Create custom fields in destination system if needed

- Configure sync rules (two-way, prefer one system, don't sync)

- Set up picklist value mappings (ensure values match between systems)

- Test mappings with sample records before full sync

4.3 Set Up Inclusion/Exclusion Rules

Control which records sync:

Inclusion List Approach:

- Only sync contacts with specific lifecycle stages (MQL and beyond)

- Advantages: Cleaner data, focused sales visibility, better security

- Disadvantages: Must manage list criteria carefully

Exclusion List Approach:

- Sync all contacts except those meeting exclusion criteria

- Exclude: employees, partners, competitors, test records

- Advantages: Simpler configuration, less risk of missing important contacts

- Disadvantages: Larger data volume, potential for irrelevant data in CRM

Recommendation for Financial Services: Use inclusion list starting with MQL stage and above. Expand as team gains confidence.

Step 5: Build Automation Workflows (Weeks 5-6)

5.1 Lead Scoring Configuration

Implement the scoring model designed in Step 2.3:

- Create scoring rules in marketing automation platform

- Assign point values for demographic attributes

- Set up behavioral tracking and point assignments

- Configure score decay rules

- Map lead score to CRM field

- Set up sync to update CRM in real-time

5.2 Lead Lifecycle Automation

Build workflows that move leads through stages:

Workflow 1: MQL Handoff

- Trigger: Lead score reaches 50 or form submission with "Request Contact" checked

- Actions:

- Update lifecycle stage to "MQL" in both systems

- Create CRM task assigned to sales development rep

- Send internal notification email/Slack alert

- Log activity "Lead became MQL" with timestamp

- Wait 2 days → if task not completed, send reminder

Workflow 2: SQL Promotion

- Trigger: Lead score reaches 100 or sales manually converts to opportunity

- Actions:

- Update lifecycle stage to "SQL"

- Create CRM opportunity record

- Assign to appropriate account executive (based on territory rules)

- Send alert to AE with lead intelligence summary

- Enroll contact in "Sales Follow-Up" email sequence

Workflow 3: Engagement Re-Engagement

- Trigger: No email engagement or website activity for 60 days AND not in active opportunity

- Actions:

- Update contact property "Engagement Status" to "At Risk"

- Enroll in re-engagement email campaign

- If no engagement after 30 days, mark as "Dormant" and suppress from future campaigns

- If re-engages, reset status to "Active" and restart scoring

5.3 Sales Enablement Automation

Create workflows that provide intelligence to sales teams:

High-Intent Activity Alerts:

- Trigger: Contact visits pricing page

- Action: Send Slack/email alert to owner: "[Name] from [Company] just viewed pricing page—reach out now!"

Content Engagement Notifications:

- Trigger: Contact downloads case study or watches demo video

- Action: Create CRM task with note: "[Name] engaged with [Content Title]—follow up with related conversation"

Buying Committee Identification:

- Trigger: 3+ contacts from same company engage within 7 days

- Action: Send alert to account owner: "Increased activity from [Company]—potential buying committee emerging"

5.4 Post-Sale Client Workflows

Automate client onboarding and retention:

Onboarding Sequence:

- Trigger: Opportunity status = Closed/Won

- Actions:

- Change lifecycle stage to "Customer"

- Enroll in welcome email series (7 emails over 30 days)

- Create CRM tasks for customer success team (kickoff call, training, check-ins)

- Send internal notification to CS team with opportunity details

- Tag contact for monthly newsletter

Renewal Reminder Workflow:

- Trigger: 90 days before renewal date (custom date field)

- Actions:

- Create CRM task for account executive

- Send usage report email to customer

- 60 days before: Send case study and testimonials

- 30 days before: Send renewal reminder with easy approval link

- 7 days before: Escalate to management if renewal not secured

Step 6: Test Integration Thoroughly (Week 7)

6.1 Unit Testing

Test individual components:

- Create test contact in marketing automation → verify appears in CRM

- Update test contact in CRM → verify changes sync to marketing automation

- Submit test form → verify workflow triggers correctly

- Assign test lead to sales rep → verify ownership syncs

- Update opportunity stage → verify syncs and triggers automation

6.2 End-to-End Testing

Test complete business processes:

Test Scenario 1: New Lead Acquisition

- Submit website form as prospect

- Verify contact created in marketing automation with correct data

- Confirm lead created in CRM with proper assignment

- Check that welcome email sends automatically

- Engage with email (open/click)

- Verify engagement scored and logged in CRM

- Download content to reach MQL threshold

- Confirm CRM task created for sales rep

Test Scenario 2: Sales Follow-Up

- Sales rep contacts lead (log call in CRM)

- Verify call logged in marketing automation

- Sales qualifies lead and creates opportunity

- Confirm opportunity syncs and contact exits nurture workflow

- Sales rep moves through opportunity stages

- Verify stages sync and appropriate automations trigger

Test Scenario 3: Data Conflict Resolution

- Update same field in both systems simultaneously

- Verify conflict resolved according to mapping rules

- Confirm no data loss or unexpected overwrites

6.3 Performance and Error Testing

- Monitor sync speed and latency

- Check error logs for any failures

- Verify API usage stays within limits

- Test with realistic data volumes

6.4 User Acceptance Testing

- Have sales and marketing users test real workflows

- Collect feedback on usability and pain points

- Document any issues or requested modifications

- Make adjustments before full rollout

Rollout Phase: Launch and Adoption

Step 7: Train Users (Week 8)

7.1 Create Training Materials

Develop role-specific documentation:

For Sales Team:

- How to view marketing engagement in CRM

- Understanding lead scores and what they mean

- How to trigger marketing campaigns from CRM

- Best practices for data entry to maintain sync

For Marketing Team:

- How to build campaigns with CRM integration

- Using CRM data for segmentation

- Monitoring campaign performance in CRM

- Lead handoff procedures and SLAs

For Leadership:

- New reporting dashboards and metrics

- How to monitor integration health

- Understanding full-funnel attribution

7.2 Conduct Training Sessions

- Hold live training webinars for each user group

- Record sessions for future reference

- Provide hands-on practice time

- Create quick reference guides and cheat sheets

- Set up office hours for questions

Step 8: Execute Phased Rollout (Weeks 9-10)

Phase 1: Pilot Program (Week 9)

- Select small group of power users (5-10 people)

- Enable integration for pilot group only

- Monitor closely for issues

- Gather detailed feedback

- Make refinements based on learnings

Phase 2: Department Rollout (Week 10)

- Enable for all sales and marketing users

- Provide extra support during transition

- Address questions quickly

- Monitor adoption metrics

- Celebrate early wins

Phase 3: Organization-Wide (Week 11+)

- Roll out to customer success, support, and other teams

- Integrate additional objects or workflows

- Expand automation scope

- Scale to full contact database

Step 9: Monitor and Optimize (Ongoing)

9.1 Establish Monitoring Dashboards

Track integration health:

- Sync Status: Number of records syncing, error rate, API usage

- Data Quality: Duplicate rate, field completeness, accuracy

- Adoption Metrics: User login frequency, feature usage, data entry compliance

- Business Metrics: Lead conversion rates, sales cycle length, win rates

9.2 Regular Maintenance Schedule

- Daily: Review error logs and resolve sync failures

- Weekly: Check data quality metrics, review high-priority alerts

- Monthly: Analyze adoption and business metrics, conduct user feedback sessions

- Quarterly: Comprehensive system audit, update documentation, strategic optimization

9.3 Continuous Improvement

- A/B test email subject lines and content

- Refine lead scoring based on conversion data

- Add new automation workflows as needs arise

- Expand integration to additional systems (accounting, support)

- Stay updated on platform releases and new features

Common Pitfalls and How to Avoid Them

Pitfall 1: Insufficient Planning

Problem: Rushing into technical setup without clear strategy

Solution: Invest time in Steps 1-2 before any configuration. Organizations that have faced failed implementations and successfully turned them around emphasize the critical importance of business-process-focused planning before technical configuration.

Pitfall 2: Poor Data Quality

Problem: Syncing dirty data perpetuates problems across systems

Solution: Mandatory cleanup in Step 3 before integration activation

Pitfall 3: Over-Complicated Initial Setup

Problem: Trying to automate everything at once overwhelms team

Solution: Start with core workflows, expand incrementally

Pitfall 4: Inadequate Testing

Problem: Launching with undiscovered bugs frustrates users

Solution: Comprehensive testing in Step 6 before rollout

Pitfall 5: Poor Change Management

Problem: Users resist new system or don't adopt properly

Solution: Training, communication, and incentives in Steps 7-8. Successful implementations require comprehensive change management that includes user training, stakeholder communication, and a focus on continuous enablement to ensure teams embrace and effectively utilize the integrated system

Pitfall 6: Set-It-and-Forget-It Mentality

Problem: Integration degrades over time without attention

Solution: Ongoing monitoring and optimization in Step 9

Success Metrics and KPIs

Measure integration success across multiple dimensions:

Technical Performance

- Sync Success Rate: Target 99%+ successful syncs

- API Usage: Stay below 80% of limit

- Error Resolution Time: Average < 24 hours

Data Quality

- Duplicate Rate: < 2% of total records

- Field Completeness: 95%+ for critical fields

- Data Accuracy: > 98% validated as correct

User Adoption

- Login Frequency: 80%+ of users active weekly

- Data Entry Compliance: 90%+ following standards

- Feature Utilization: 70%+ using key capabilities

Business Impact

- Lead Conversion Rate: 30-50% improvement

- Sales Cycle Length: 20-30% reduction

- Win Rate: 15-25% improvement

- Marketing ROI: 3-5x increase in attributed revenue

- Time Savings: 10+ hours per rep per week

Conclusion

Successful CRM and marketing automation integration follows a disciplined, step-by-step methodology that balances technical precision with organizational change management. By investing appropriate time in planning, maintaining focus on data quality, testing thoroughly, and supporting users through training and ongoing optimization, financial services firms can achieve seamless integration that delivers transformative business value.

This nine-step framework provides a proven path from initial assessment through long-term success, ensuring your integration investment generates measurable returns and competitive advantage. Organizations seeking specialized expertise in financial services CRM integration can accelerate their journey and avoid common pitfalls through partnership with consultants who understand both the technology and the unique regulatory, compliance, and operational requirements of the financial services industry.

Tomorrow's Post: Explore the strategic benefits and comparative advantages of combining CRM and marketing automation in our fourth installment.

This blog post is part of our five-part series on integrating marketing automation with CRM systems for financial services firms. We're publishing new content each day this week to provide a complete guide to transformation.

About the Author

David Cockrum is the founder of Vantage Point and a former COO in the financial services industry. Having navigated complex CRM transformations from both operational and technology perspectives, David brings unique insights into the decision-making, stakeholder management, and execution challenges that financial services firms face during migration.

Ready to begin your CRM migration journey?

Partner with Vantage Point to benefit from proven frameworks, specialized expertise, and a structured approach that de-risks your migration while accelerating time-to-value.

-

-

- Email: david@vantagepoint.io

- Phone: (469) 652-7923

- Website: vantagepoint.io

-