TL;DR - Quick Summary

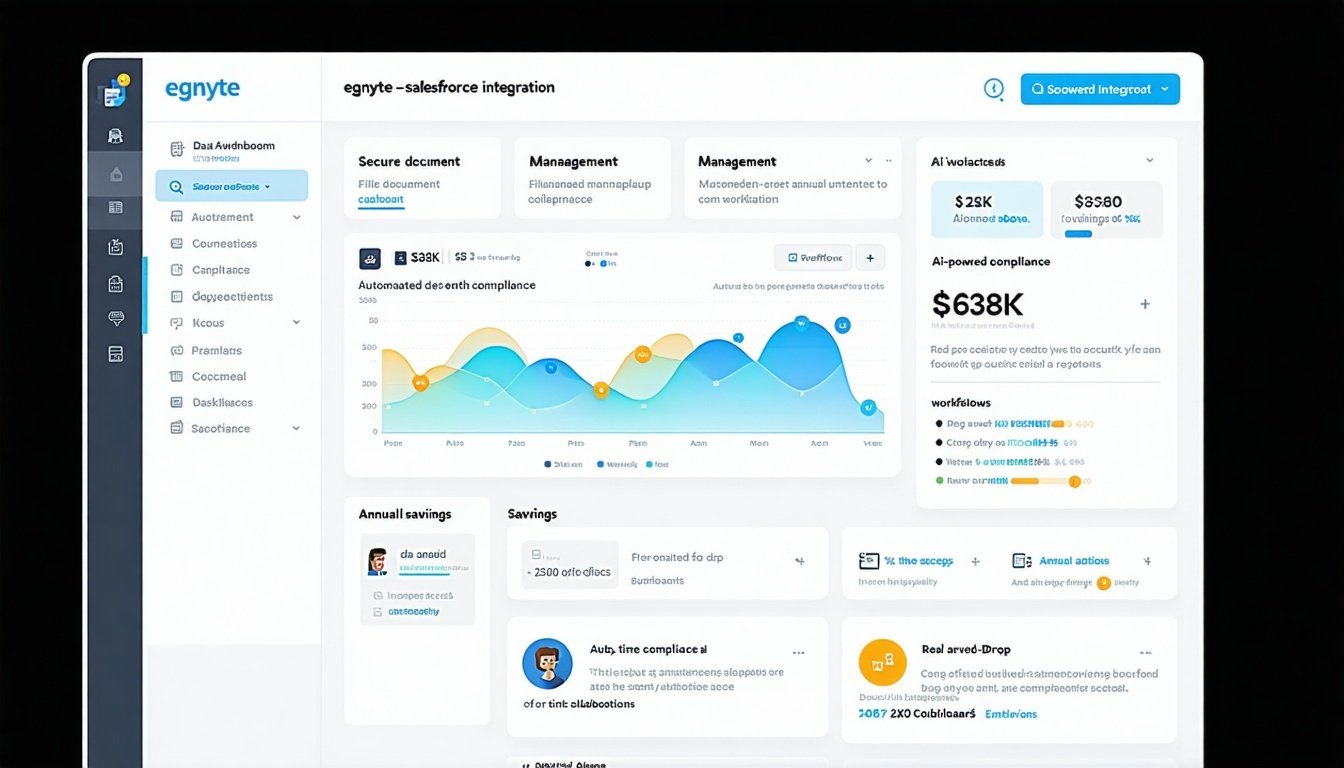

Egnyte-Salesforce integration revolutionizes financial services content management with:

- Unlimited storage and seamless file access directly within Salesforce record pages

- Comprehensive compliance support for FINRA, SEC, GDPR, HIPAA, and NAIC regulations

- Proven ROI of $638,000 annually across IT savings, productivity gains, and risk reduction

- AI-powered workflows with salesforce canvas app for automated document classification and threat detection

- Industry-specific solutions for wealth management, banking, and insurance sectors

- Enterprise-grade security with 256-bit encryption, audit trails, and ransomware protection

- Streamlined client onboarding with automated folder creation and user mapping

Over 2,200 financial services firms use Egnyte for secure, compliant content collaboration, scaling with business growth and reducing operational costs by 40%, as documented in comprehensive financial services case studies.

The Financial Services Content Management Challenge

Financial services organizations face unprecedented challenges in managing sensitive client documents while maintaining regulatory compliance. Traditional document management systems struggle with version control, secure external sharing, and complex permission structures required in regulated industries. With hybrid work models becoming the norm—66% of financial services companies now offer hybrid or remote work options according to FlexOS research—the need for secure, compliant content collaboration has never been more critical.

High stakes include non-compliance penalties, with SEC and CFTC fines reaching millions of dollars for inadequate record-keeping. Employees spend up to 20% of their time searching for information, creating productivity drains that impact client service and operational efficiency.

Why Egnyte-Salesforce Integration is the Solution

Unified Content Management Within Your CRM

Egnyte for Salesforce eliminates friction between content management and customer relationship management by embedding a complete file management interface directly within Salesforce records. This native integration supports standard Salesforce objects—Leads, Cases, Accounts, Contacts, Opportunities, and Campaigns—plus custom objects, creating a unified repository for customer documents without disrupting familiar workflows.

Source: Cloudwards Egnyte Connect Guide

Key Integration Capabilities:

- Embedded file interface with drag-and-drop functionality

- Automatic folder creation linked to Salesforce records

- Real-time bidirectional synchronization between platforms

- Cross-platform access via desktop, mobile, and web interfaces

- Seamless collaboration with non-Salesforce users without additional licenses

Enterprise-Grade Security and Compliance

Financial services organizations require more than basic file sharing—they need comprehensive security frameworks that meet stringent regulatory requirements. Egnyte provides bank-grade protection with multiple security layers and automated compliance features.

Source: Egnyte Help Desk - Advanced Security Features

Security Framework:

- 256-bit AES encryption for data at rest and in transit

- Granular access controls with role-based permissions

- Multi-factor authentication and single sign-on integration

- Immutable audit trails for all file access and modifications

- Ransomware detection and protection with automated threat response

- Watermarking for sensitive document previews

Compliance Standards Supported:

- Global Standards: ISO/IEC 27001:2022, SOC 2 Type 2, Cyber Essentials

- Financial Regulations: FINRA, SEC Rule 17a-4, GLBA, FFIEC Guidelines

- Data Privacy: GDPR, CCPA/CPRA, HIPAA, 21 CFR Part 11

- Industry-Specific: NAIC requirements, CMMC 2.0, DFARS compliance

Business Benefits and ROI Analysis

Quantified Financial Impact

Organizations implementing Egnyte-Salesforce integration report substantial cost savings and productivity improvements across multiple categories, as documented in comprehensive ROI analysis reports:

Source: Egnyte Help Desk - Collaboration between Egnyte Users

Annual ROI Breakdown:

- IT Cost Savings: $130,000 (40% reduction in file administration costs)

- Productivity Gains: $424,000 (50 hours saved per user annually)

- Risk Reduction: $88,000 (improved security and compliance controls)

- Total Annual Savings: $638,000

- Three-Year ROI: $1.9 million

Operational Efficiency Improvements

Storage and Infrastructure:

- Eliminate expensive file servers and backup systems

- Unlimited storage capacity without Salesforce storage limitations

- Scalable architecture supporting rapid organizational growth

- Reduced need for additional Salesforce licenses for file access

Workflow Optimization:

- Automated folder creation and document organization

- Streamlined approval processes with e-signature integration

- Enhanced collaboration across departments and external partners

- Faster contract and proposal workflows

Customer Experience Enhancement:

- Unified view of customer documents within familiar Salesforce interface

- Faster response times to customer requests

- Improved collaboration on proposals and presentations

- Seamless handoffs between sales stages and departments

Technical Architecture and Implementation

System Requirements and Compatibility

Source: Egnyte Cloud Deployment Solutions

Salesforce Editions Supported:

- Group, Enterprise, or Unlimited editions required

- Minimum two free permission sets needed

- System Administrator privileges for installation

- Support for both Salesforce Classic and Lightning Experience

Integration benefits are well-documented by leading analyst firms, with Salesforce recognized as a Leader in Gartner's 2024 Magic Quadrant for Customer Data Platforms for its comprehensive integration capabilities.

Integration Technology:

- Canvas App Framework for embedded Egnyte interface

- RESTful API integration with configurable batch processing

- Visualforce pages for Lightning Experience implementation

- Remote Site Settings for secure communication

Installation and Configuration Process

Source: Egnyte Help Desk - Salesforce Administration Guide

Pre-Installation Planning:

- Verify Salesforce edition and license requirements

- Identify objects requiring integration

- Plan folder hierarchy and naming conventions

- Define permission structures and access policies

- Schedule sandbox testing environment

Implementation Steps:

- Download package from the official Salesforce AppExchange listing

- Install for all users with proper permissions

- Configure Egnyte Domain settings and authentication

- Set up Remote Site Settings and Canvas App integration

- Create folder templates and sync configurations

- Configure Lightning Experience Visualforce pages

- Establish user training and change management programs

Advanced Configuration Options

Folder Management:

- Hierarchical folder structures based on Salesforce relationships

- Custom folder naming using Salesforce field data

- Parent-child object relationships for organized file structures

- Bulk template application for existing records

Automation Features:

- Automatic upload of Salesforce Notes and Attachments

- Metadata stamping with Salesforce field data

- Workflow automation with Salesforce Flow integration

- Third-party integrations via Zapier for no-code automation

Financial Services Use Cases

Wealth Management: Streamlined Client Advisory

Source: Egnyte Solutions - Sharing & Collaboration

Regulatory Compliance Requirements:

Wealth management firms must navigate complex FINRA and SEC regulations, including 7-year document retention requirements and comprehensive audit trail maintenance. Traditional systems often struggle with permission inheritance issues and version control problems that create compliance risks.

Egnyte-Salesforce Solution:

The integration provides granular access controls that eliminate permission inheritance problems while maintaining comprehensive audit trails. AI-powered classification automatically identifies and protects sensitive content, including PII and PHI, ensuring compliance with SEC Rule 17a-4 and FINRA requirements.

Real-World Success: EP Wealth Advisors

EP Wealth Advisors implemented Egnyte-Practifi (Salesforce-based) integration to address complex permission structures causing collaboration difficulties. Results included:

- Considerable productivity benefits across client advisors, operations, portfolio management, and financial planning departments

- Enhanced data protection meeting SEC and GLBA requirements

- Improved collaboration without permission inheritance issues

- Streamlined audit processes with comprehensive, immutable audit trails

Client Onboarding Optimization:

- Custom-branded client portals for secure document collection

- Automated folder creation for new Salesforce leads and accounts

- E-signature workflow integration with DocuSign and Adobe Sign

- Automated compliance checks during onboarding processes

Banking: Secure Document Workflows at Scale

Compliance Framework:

Banking institutions must comply with federal regulations, including GDPR, CCPA, SOC 2 Type 2, and FFIEC Guidelines. The integration supports Know Your Customer (KYC) document management and automated governance for regulatory reporting.

Operational Challenges Addressed:

- Legacy system integration with modern cloud solutions

- High storage costs from traditional file servers

- Limited scalability for growing document volumes

- Manual compliance processes for regulatory reporting

Quantified Results: Wintrust Financial Case Study

Wintrust Financial, a $64 billion asset financial holdings company with 5,500 employees, achieved remarkable results:

- Scalable Growth: Added $20 billion in assets and 2,000 employees without significant storage cost increases

- Threat Response: Reduced threat detection time from "months" to "immediate"

- Data Governance: Achieved comprehensive automated classification and retention

- User Adoption: High adoption rates due to intuitive interface and functionality

- System Reliability: Eliminated issues with missing links, poor support, and system downtimes

Banking-Specific Benefits:

- Hybrid architecture connecting cloud and on-premises systems

- Automated KYC document workflows and compliance verification

- Integration with core banking platforms and risk management systems

- Customer self-service portals for document submission and tracking

Insurance: Automated Claims and Compliance

NAIC Regulatory Compliance:

Insurance companies must comply with NAIC Model Laws, including Health Insurance Reserves, Group Health Standards, and Utilization Review requirements. The integration provides automated PHI classification and comprehensive audit trails for medical benefit approvals, supporting enterprise content management security requirements.

Industry-Specific Challenges:

- Claims processing bottlenecks from manual document handling

- Regulatory complexity across multiple jurisdictions

- Large file volumes for policies, claims, and medical records

- Secure collaboration with healthcare providers and regulatory bodies

Solution Architecture:

- AI-powered identification of PHI, PII, and regulated content

- Policy-driven retention based on insurance-specific schedules

- Encrypted sharing with healthcare providers and regulatory agencies

- Integration between claims management systems and document repositories

Real-World Implementation: PIB Group (UK Insurance)

PIB Group successfully managed risk and protected data during acquisitions while consolidating terabytes of information:

- Reduced processing times through automated workflows

- Enhanced data governance at the source with policy-driven management

- Improved risk management during M&A activities

- Streamlined compliance across multiple jurisdictions

Insurance Workflow Optimization:

- Product-specific folder templates for various insurance types

- Automated underwriting document workflows

- Multi-party collaboration with agents, brokers, and third-party administrators

- Customer portal integration for claims submissions and policy updates

Geographic Optimization and Data Residency

Global Compliance Considerations

Financial services organizations operating across multiple jurisdictions face complex data residency and privacy requirements. Egnyte's hybrid architecture provides granular control over data location while maintaining seamless collaboration capabilities.

Regional Compliance Support:

- European Union: GDPR compliance with EU-specific data residency controls

- United Kingdom: Data Protection Act 2018 and post-Brexit requirements

- Asia-Pacific: MAS (Singapore), APRA (Australia), and local banking regulations

- North America: CCPA/CPRA, SOX, and state-specific privacy laws

Data Residency Features:

- Hybrid deployment options for sensitive data control

- Geographic data distribution with policy-driven placement

- Cross-border data transfer controls with Standard Contractual Clauses

- Automated data discovery and classification for governance

Multi-Jurisdictional Implementation

Regulatory Harmonization:

The platform supports organizations operating across multiple regulatory environments by providing flexible policy frameworks that can be customized for different jurisdictions while maintaining centralized governance and oversight.

Global Deployment Benefits:

- Consistent security controls across all geographic locations

- Automated compliance reporting for multiple regulatory bodies

- Centralized audit capabilities for global regulatory examinations

- Scalable architecture supporting international expansion

AI-Powered Content Intelligence

Automated Document Classification

Egnyte's AI capabilities transform how financial services organizations manage and discover content. Machine learning algorithms automatically classify documents based on content type, sensitivity level, and regulatory requirements, as highlighted in Gartner's analysis of content collaboration platforms.

AI Features:

- Conversational AI for document summarization and data extraction

- Automated due diligence workflows for investment decisions

- Sensitive content classification and protection

- Intelligent search across all client documents and communications

- Predictive analytics for usage patterns and risk assessment

Threat Detection and Response

Advanced AI monitors file access patterns and user behavior to identify potential security threats before they impact operations.

Security Intelligence:

- Real-time monitoring of file access patterns

- Automated threat detection using built-in intelligence

- Anomaly detection for suspicious login attempts

- Insider threat protection capabilities

- Automated incident response and notification workflows

Implementation Best Practices

Change Management Strategy

Source: Egnyte Solutions - AI Workflow

Phased Deployment Approach:

- Phase 1: Pilot implementation with high-impact use cases

- Phase 2: Department-by-department rollout with champion programs

- Phase 3: Full organizational deployment with advanced features

- Phase 4: Optimization and continuous improvement

User Adoption Factors:

- Comprehensive training programs for different user roles

- Integration with existing workflows to minimize disruption

- Clear communication of benefits and ROI to stakeholders

- Ongoing support and feedback collection mechanisms

Security and Governance Framework

Access Control Management:

- Role-based permissions aligned with organizational structure

- Regular access reviews and automated deprovisioning

- Guest user support for external collaboration

- Consistent permission enforcement across all access points

Compliance Monitoring:

- Automated policy enforcement and violation detection

- Regular compliance audits and third-party assessments

- Comprehensive documentation and audit trail maintenance

- Incident response procedures and regulatory notification workflows

Performance Optimization and Scalability

System Performance Considerations

Optimization Strategies:

- Configurable batch sizes for large-scale operations (recommended: 200 max)

- Queue-able and Batch Apex processing modes for efficiency

- Network bandwidth optimization for large file transfers

- API call limit management for real-time synchronization

Scalability Planning:

- Growth accommodation for expanding user bases

- Performance optimization for increased data volumes

- Geographic expansion considerations and data placement

- Technology evolution planning for platform updates

Monitoring and Maintenance

Ongoing Management Requirements:

- Regular monitoring of sync queue processing

- Periodic review of permission configurations and access patterns

- Compliance monitoring and reporting automation

- Version upgrade planning and testing procedures

Performance Metrics:

- File access and collaboration usage statistics

- Compliance adherence and audit trail completeness

- User adoption rates and satisfaction scores

- System performance and availability metrics